What is Ethereum? Analyze the core technology of Blockchain 2.0 and its revolutionary applications

summary:

The Difference Between Ether and Ethereum: How Smart Contracts Are Reshaping the Blockchai...

summary:

The Difference Between Ether and Ethereum: How Smart Contracts Are Reshaping the Blockchai... 文章目录

The Difference Between Ether and Ethereum: How Smart Contracts Are Reshaping the Blockchain Ecosystem

Ether (ETH) Price Trends & Charts

Ether (ETH) is the second-largest cryptocurrency globally by market capitalization, second only to Bitcoin. As the native currency of the Ethereum blockchain, it is renowned for its efficiency, flexibility, and extensive use cases. At the same time, many of us often hear the term "Ethereum" and may mistakenly think these are the same thing. In reality, "Ether" and "Ethereum" are distinct concepts, with smart contracts and decentralized applications (DApps) being crucial technological components of Ethereum's ecosystem.

This article will detail the distinctions between Ether and Ethereum, explore how smart contracts have spurred the development of DApps, and examine how these elements are reshaping the blockchain ecosystem. Let’s dive in.

Ether and Ethereum: Concepts & Differences

First, it's important to clarify that Ethereum and Ether (ETH) are not the same thing. Their relationship can be compared to that of a country and its national currency:

Ethereum is a decentralized blockchain platform developed based on blockchain technology, similar to a "national machine" that provides various blockchain services.

Ether (ETH) is the native cryptocurrency issued on the Ethereum blockchain. It functions like a country's national currency, allowing users to execute various transactions on the Ethereum blockchain.

In simple terms, Ethereum is a multifunctional blockchain platform allowing developers to create decentralized applications (DApps), while Ether (ETH) serves as the payment mechanism and fee token on the Ethereum blockchain. ETH is used to pay for "gas fees"—the cost associated with executing smart contracts—and is vital for trading, voting, and engaging in decentralized finance (DeFi) applications.

Introduction to Ethereum

Ethereum was proposed by Vitalik Buterin, a Russian-born Canadian, in 2013 and officially launched in 2015. Its goal is to enable decentralized applications (DApps) to operate autonomously using smart contracts, without relying on traditional centralized servers.

Ethereum differs from Bitcoin in its objectives. Bitcoin's main purpose is to act as a peer-to-peer cryptocurrency payment system, while Ethereum introduces smart contracts to allow users to build diverse DApps. Thus, Ethereum can be understood as a blockchain platform supporting a variety of smart contracts and decentralized ecosystems.

Analyzing the Value of Ether (ETH)

Ether (ETH) is one of the world's most popular cryptocurrencies. Its value is driven by several factors, including its strong developer ecosystem, on-chain data market leadership, deflationary mechanisms caused by inflation reduction, and institutional investments. Below is a detailed analysis of the driving forces behind Ether's value.

1. The Most Active Developer Ecosystem

Ethereum’s strength lies in its highly active developer ecosystem. According to Electric Capital’s January 2023 developer report, Ethereum leads the blockchain space with the most developer tools, applications, and protocols. The number of full-time developers working on Ethereum is 1,873—far surpassing Polkadot (752), Cosmos (511), and Solana (383).

This large developer community has turned Ethereum into more than just a blockchain protocol. It's a dynamic ecosystem that supports various DeFi projects such as Uniswap, MakerDAO, Aave, 1INCH, Curve Finance, The Sandbox, and Decentraland. These projects foster Ethereum’s ecosystem growth and enhance Ether's market visibility and credibility.

Ethereum's vibrant developer ecosystem directly influences the demand for Ether as more users and developers enter the space.

2. Dominance in On-Chain Data

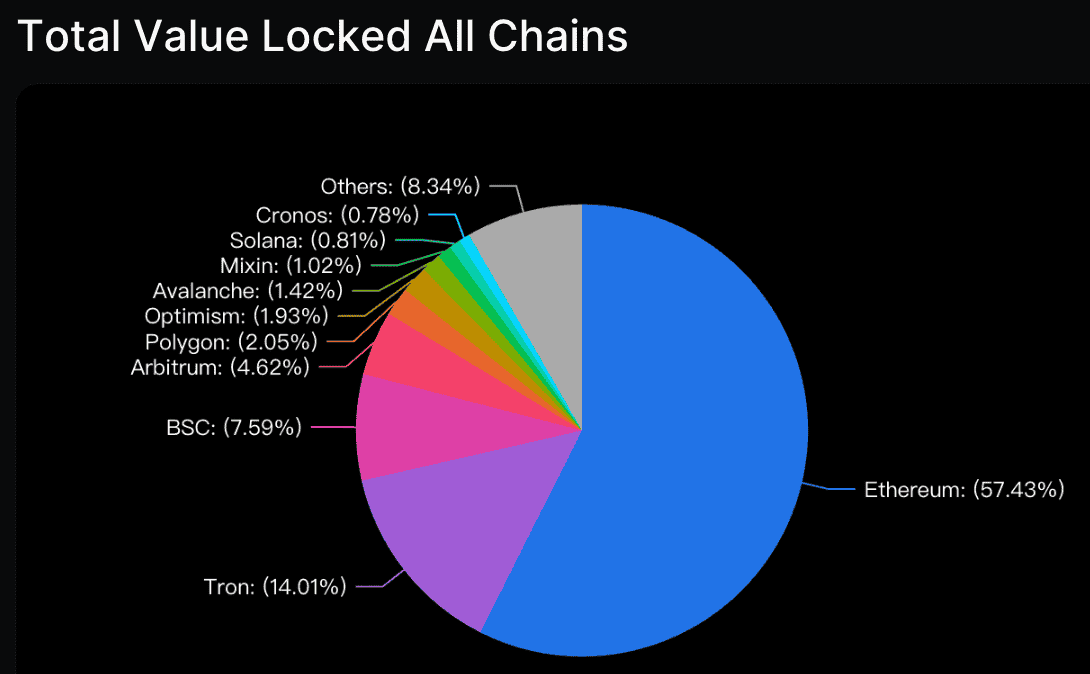

Ethereum has consistently led in key blockchain data metrics. According to DeFiLlama, as of August 2023, Ethereum demonstrated market dominance with substantial liquidity:

Total Value Locked (TVL): Ethereum's TVL accounts for 57.43% of the market, far surpassing Tron’s 14.01% and BNB’s 7.59%. This indicates Ethereum’s leadership in decentralized finance (DeFi) liquidity.

Gas Fees: In the past 24 hours, Ethereum processed gas fees totaling $5 million, compared to Tron’s $1.05 million and BNB’s $26,300. This showcases Ethereum’s role as a core blockchain for DeFi transactions and increased demand for Ether.

DEX Trading Volume: Ethereum's 24-hour trading volume in decentralized exchanges was $15.04 billion, far exceeding BNB’s $3.01 billion and Arbitrum’s $2.98 billion.

These figures confirm Ethereum’s leading DeFi role and the growing demand for Ether.

3. Ether’s Deflationary Mechanism

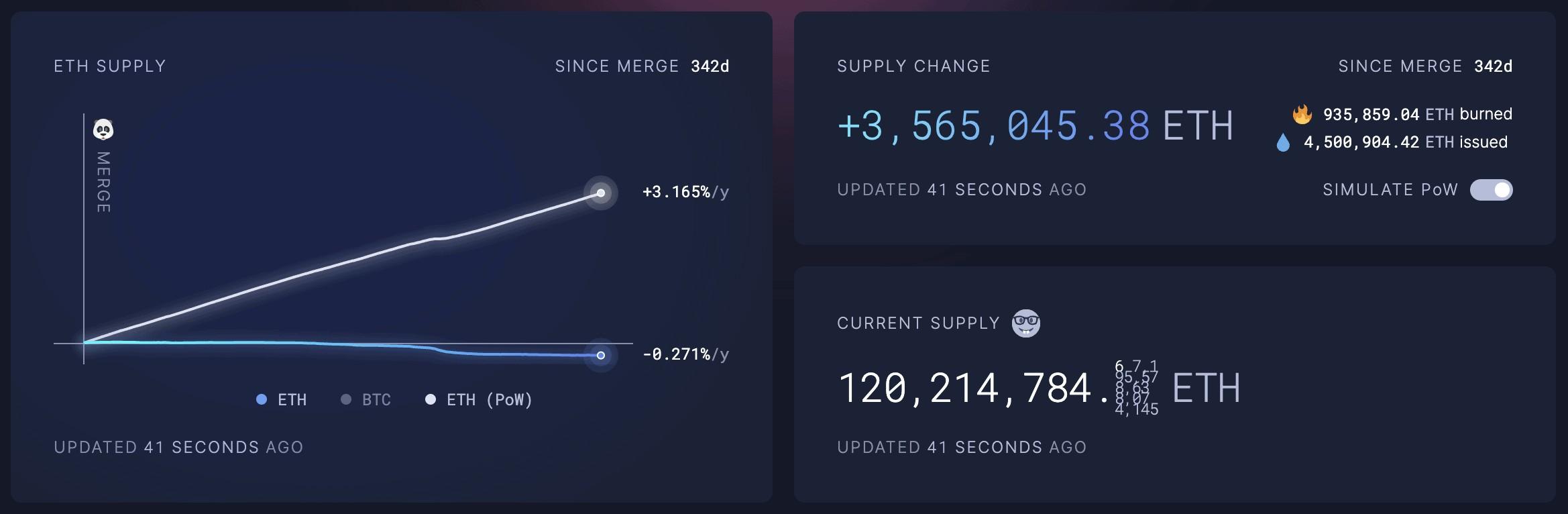

Ether's price is also driven by its deflationary economic mechanisms. On September 15, 2023, Ethereum transitioned from proof-of-work (PoW) to proof-of-stake (PoS) with the Merge upgrade. This change drastically reduced the annual inflation rate of Ether, resulting in net issuance rates becoming negative—indicating deflation.

Furthermore, Ethereum implemented EIP-1559 in August 2022. This proposal split blockchain transfer fees into two components:

Base Fee: Burned and removed from circulation.

Tips: Paid to miners to incentivize faster transaction processing.

This deflationary mechanism reduces the number of Ether tokens in circulation, contributing to Ether's value increase if demand rises.

4. Institutional Funds Enter the Market

Institutional investment is another critical factor contributing to Ether’s value. In August 2023, major U.S.-based funds like Volatility Shares, Bitwise, Roundhill, VanEck, Grayscale, Direxion, and ProShares filed for Ethereum futures ETFs. Bloomberg’s ETF analyst Eric Balchunas predicts a high probability of these ETFs’ approval, likely to launch in October 2023.

Furthermore, prominent investment firm ARK Invest also plans to launch an Ether spot ETF. These funds indicate a growing market confidence in Ether’s long-term potential, boosting market liquidity and opportunities for institutional investment.

Key Risks for Ether Investors

Investors interested in Ether should consider these five main risks:

Price Volatility: Ether is highly volatile, with price swings of 20%-30% possible within short periods due to market sentiment, technological updates, and regulatory changes.

Regulatory Risks: Regulations, particularly from countries like the United States, add uncertainty to Ether’s market position.

Technological Upgrades: Ethereum's ongoing updates (e.g., The Merge and others) introduce risks related to delays, technical failures, and investor uncertainty.

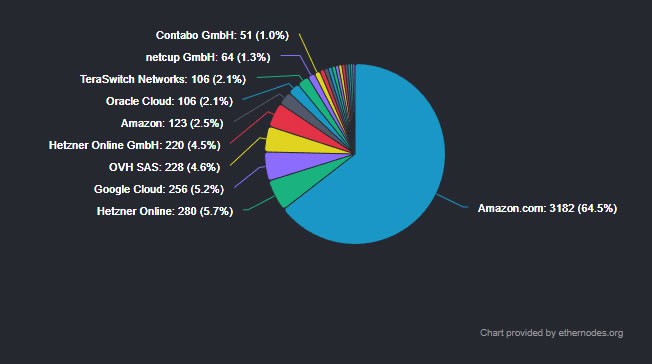

Node Centralization: Around 64.5% of Ethereum nodes rely on centralized services like Amazon Web Services, creating risks if disruptions occur.

Competition from Other Blockchains: Competing projects like BNB Smart Chain, Solana, and others threaten Ethereum's market share with technological innovations and lower fees.

Smart Contracts: Ethereum’s Core Technology

Smart contracts are self-executing programs running on the Ethereum blockchain. They operate automatically under pre-defined conditions, similar to a vending machine:

Insert a coin and select a product.

The smart contract verifies the condition.

If valid, it releases the product.

Applications of Smart Contracts

Smart contracts have revolutionized various industries, enabling:

DeFi (Decentralized Finance): Borrowing, lending, and trading without intermediaries.

DAO (Decentralized Autonomous Organizations): Community-driven organizations governed by blockchain voting.

NFTs & Digital Assets: Tokenizing unique assets like art and collectibles.

Gaming (GameFi): Creating "play-to-earn" opportunities by integrating NFTs and blockchain into games.

Ethereum 2.0 & Its Future

Ethereum 2.0 introduces technological upgrades to solve scalability and gas fee issues:

PoS Consensus Mechanism: Transitioning from PoW to PoS improves transaction efficiency and reduces energy consumption.

Layer 2 Scaling Solutions: Technologies like Arbitrum and zkSync alleviate congestion and improve transaction speed through off-chain processing.

These upgrades aim to improve user experience, reduce fees, and support DApps and smart contracts.

Tags:

Ether, Ethereum, Smart Contracts, Decentralized Applications, DeFi