Gold selloff turns to Bitcoin? Michael Saylor strongly recommends that the United States enter the B

summary:

Gold selloff turns to Bitcoin? Michael Saylor strongly recommends that the United States e...

summary:

Gold selloff turns to Bitcoin? Michael Saylor strongly recommends that the United States e... Gold selloff turns to Bitcoin? Michael Saylor strongly recommends that the United States enter the BTC investment battlefield

MicroStrategy Founder Michael Saylor Proposes Controversial "National Bitcoin Strategy" to Strengthen U.S. Global Economic Leadership

Michael Saylor, the founder of MicroStrategy, has recently proposed a highly controversial and impactful strategic vision aimed at solidifying the United States' position on the global economic stage. This strategy is dubbed the "National Bitcoin Strategy". Its core idea involves the U.S. government selling its gold reserves to invest heavily in Bitcoin, thereby strengthening its leadership within the global "reserve capital network."

U.S. Strategy: Selling Gold Reserves to Invest in Bitcoin

According to Michael Saylor's statements in recent interviews, if the U.S. government were to liquidate its gold reserves, it could potentially acquire around 5 million Bitcoin. This number is substantial and, if executed, would significantly elevate the U.S.'s dominance in the global reserve asset market while potentially reshaping international geopolitical competition. Saylor emphasized that this investment could be achieved at "near zero cost"—primarily by leveraging funds generated from selling its gold reserves.

Saylor's strategic objectives are multifaceted. On the one hand, this move would solidify the U.S.'s core position in the global economic system, while simultaneously weakening the relative value of other nations' reserve assets. He argues that by liquidating gold reserves and purchasing Bitcoin, the U.S. would enhance its influence within the global "reserve capital network."

Moreover, Saylor believes that successful implementation of this strategy could boost Bitcoin’s market demand, potentially driving Bitcoin's total market capitalization to an unprecedented $1 trillion. This projection suggests that Bitcoin could emerge as a replacement for traditional gold and fiat currencies, establishing itself as the dominant form of global reserve assets.

MicroStrategy’s Strategic Bitcoin Accumulation Model

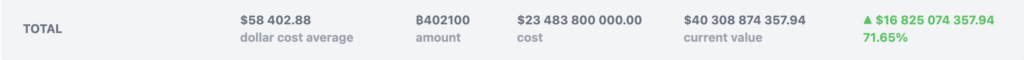

Under Michael Saylor's leadership, MicroStrategy has been actively implementing Bitcoin investment strategies over recent years. As a publicly traded company, MicroStrategy has utilized Bitcoin investments to strengthen its financial foundation. Recent data shows that MicroStrategy has accumulated over 402,100 Bitcoin, with these assets currently valued at over $23 billion. The company’s average purchase price is approximately $58,402 per Bitcoin.

The company uses SaylorTracker, a Bitcoin price-tracking tool introduced by Saylor himself on social media, to monitor Bitcoin’s price movements and market trends. This suggests that MicroStrategy may continue its large-scale Bitcoin purchases. Historically, MicroStrategy has exhibited this behavior—after releasing Bitcoin-related data, the company has often engaged in significant purchases in the short term to maintain its influence within the digital asset market.

For example, in November, MicroStrategy revealed that it had spent $2.03 billion to purchase 27,200 Bitcoin, solidifying its position as one of the largest Bitcoin-holding companies among public firms worldwide. By the end of the same month, MicroStrategy invested another $1.5 billion into Bitcoin, demonstrating its unwavering confidence in Bitcoin as a strategic financial asset.

Bitcoin as a Financial Reserve Strategy

Currently, MicroStrategy views Bitcoin as a vital component of its financial reserve strategy. This investment approach aims to generate economic benefits for shareholders over the long term. Bitcoin is being used by MicroStrategy as a hedge against market volatility, while its market performance has also contributed significantly to the company’s financial growth.

Data reveals that as of early December 2024, MicroStrategy's Bitcoin investment has achieved a 63.3% basic return, with net gains of approximately 119,800 Bitcoin, translating to an overall profit close to $12.3 billion. This success has positioned MicroStrategy as one of the fastest-growing companies benefiting from a strategic focus on Bitcoin investment.

As a financial innovator, MicroStrategy aims to diversify its investment strategy by incorporating Bitcoin, providing shareholders with higher returns while also hedging against risks from global economic uncertainty.

Introducing SaylorTracker: A Tool for Bitcoin Market Transparency

To help markets and investors gain a clearer understanding of MicroStrategy’s Bitcoin investment strategies, Michael Saylor introduced SaylorTracker, an online Bitcoin price-tracking tool. SaylorTracker offers users a visual analysis of Bitcoin price trends and investment movements, allowing them to track the timing of MicroStrategy’s Bitcoin purchases and changes in market averages.

The tool uses blue dots to represent each purchase, and users can hover over these dots to view specific purchase data and market trends. This offers investors insights into MicroStrategy’s market strategy while also showcasing the company’s interactive relationship with the Bitcoin market.

Impact on the Bitcoin Market

If the U.S. were to implement this large-scale strategy of selling gold reserves and converting them into Bitcoin, the market would likely experience profound effects.

Market Demand and Bitcoin’s Price Support: Such a move would likely drive Bitcoin's market demand significantly upward, bolstering its price stability.

Shift in Market Structures: A change of this magnitude could disrupt traditional markets—especially the gold market—and prompt other nations to reconsider their reserve strategies and asset allocations.

Geopolitical Implications: This strategy could affect geopolitical rivals holding large gold reserves, exposing them to risks of asset devaluation. This shift would likely lead to a redefinition of international financial structures.

These market movements would prompt investor attention and concern about the scale of U.S. gold reserves' liquidation, Bitcoin market trends, and global monetary policy adjustments.

Investor Sentiment and Market Response

Investors are closely monitoring MicroStrategy’s strategic decisions, particularly as it continues to expand its Bitcoin reserves. Many investors are focused on key variables, such as:

The scale of U.S. government gold reserves liquidation.

Market responses to Bitcoin price trends.

Changes in global monetary policy.

Through consistent Bitcoin purchases, MicroStrategy has also contributed to bolstering investor confidence in Bitcoin. This approach, along with other market trends, underscores the strategic importance of Bitcoin for long-term market behavior.

Bitcoin’s Long-Term Outlook

With institutional investors increasingly adding Bitcoin to their portfolios, Bitcoin is transitioning from a speculative asset to a vital tool for strategic asset allocation. Michael Saylor’s proposed National Bitcoin Strategy reflects not only MicroStrategy's strategic financial approach but also broader U.S. economic policy ambitions.

Analysts predict that as demand for Bitcoin grows, the market could expand further. Companies like MicroStrategy are well-positioned for future market shifts by maintaining long-term strategies involving Bitcoin as a financial reserve. Through strategic accumulation, Saylor and his leadership team are reinforcing the company’s long-term economic strategy.

Keywords: Bitcoin, MicroStrategy, Michael Saylor, gold reserves, SaylorTracker