DePIN Analysis: Grasp new opportunities in blockchain and explore the most undervalued currency narr

summary:

DePIN Analysis: Grasp new opportunities in blockchain and explore the most undervalued cur...

summary:

DePIN Analysis: Grasp new opportunities in blockchain and explore the most undervalued cur... 文章目录

DePIN Analysis: Grasp new opportunities in blockchain and explore the most undervalued currency narrative

What is DePIN?

DePIN stands for Decentralized Physical Infrastructure Network. It is an innovative infrastructure model driven by blockchain technology, relying on a token-based economic system and incentive mechanisms to encourage global participants to collaboratively build and maintain physical infrastructure. DePIN represents the intersection of blockchain technology and physical infrastructure, demonstrating the prospects and potential of decentralized technologies.

What is Physical Infrastructure?

Here, physical infrastructure refers to essential physical services required in daily life, such as wireless networks, energy, AI computing power, and storage space. These are indispensable in modern societies, serving billions of users worldwide. However, traditional physical infrastructures typically depend on centralized investments by large corporations, which expose them to risks such as single points of failure, high management costs, and slow deployment speeds.

Why Shift to a “Decentralized” Model?

DePIN introduces blockchain technology through a decentralized model and uses a token economy as an incentive tool. It transfers infrastructure management rights to user groups to mitigate the shortcomings of traditional centralized models. Through decentralized deployment, DePIN enables faster and more scalable infrastructure construction while truly implementing decentralization and the Web3 vision.

Is DePIN Similar to DeFi or GameFi?

Yes, DePIN can be viewed as another application within the Web3 ecosystem, similar to DeFi (Decentralized Finance) and GameFi (Decentralized Gaming). By using cryptocurrencies as economic incentives, users can participate in infrastructure building to achieve Work to Earn—earning tokens through actual contributions.

How Does DePIN Work?

The core concept of DePIN revolves around three main participant roles, forming an interconnected ecosystem.

1. Three Key Participants in DePIN

DePIN consists of three primary roles:

Service Providers (Supply Side): These are participants who contribute resources and computing power to the platform and earn cryptocurrency rewards by offering real infrastructure services.

Service Users (Demand Side): Users who utilize the infrastructure services provided by DePIN and pay fees using tokens.

Platform Operators (Project Teams): These entities maintain and operate the entire DePIN platform, ensuring the connection between service providers and service users.

An intuitive analogy is to view DePIN as a decentralized “ride-hailing platform,” such as Uber. The service providers are the drivers, the service users are the passengers, and the platform operators act as the bridge connecting these two groups.

2. Platform Growth Pathway

The development path of a DePIN platform typically follows three steps:

Token Issuance by Platform Operators: Tokens are issued as incentives to attract users and service providers.

Service Providers Join DePIN by Contributing Resources: Participants can contribute resources such as computing power or storage space to join the platform and earn token rewards.

Service Users Begin to Use Platform Services: Market demand is created through user engagement, driving platform revenue growth.

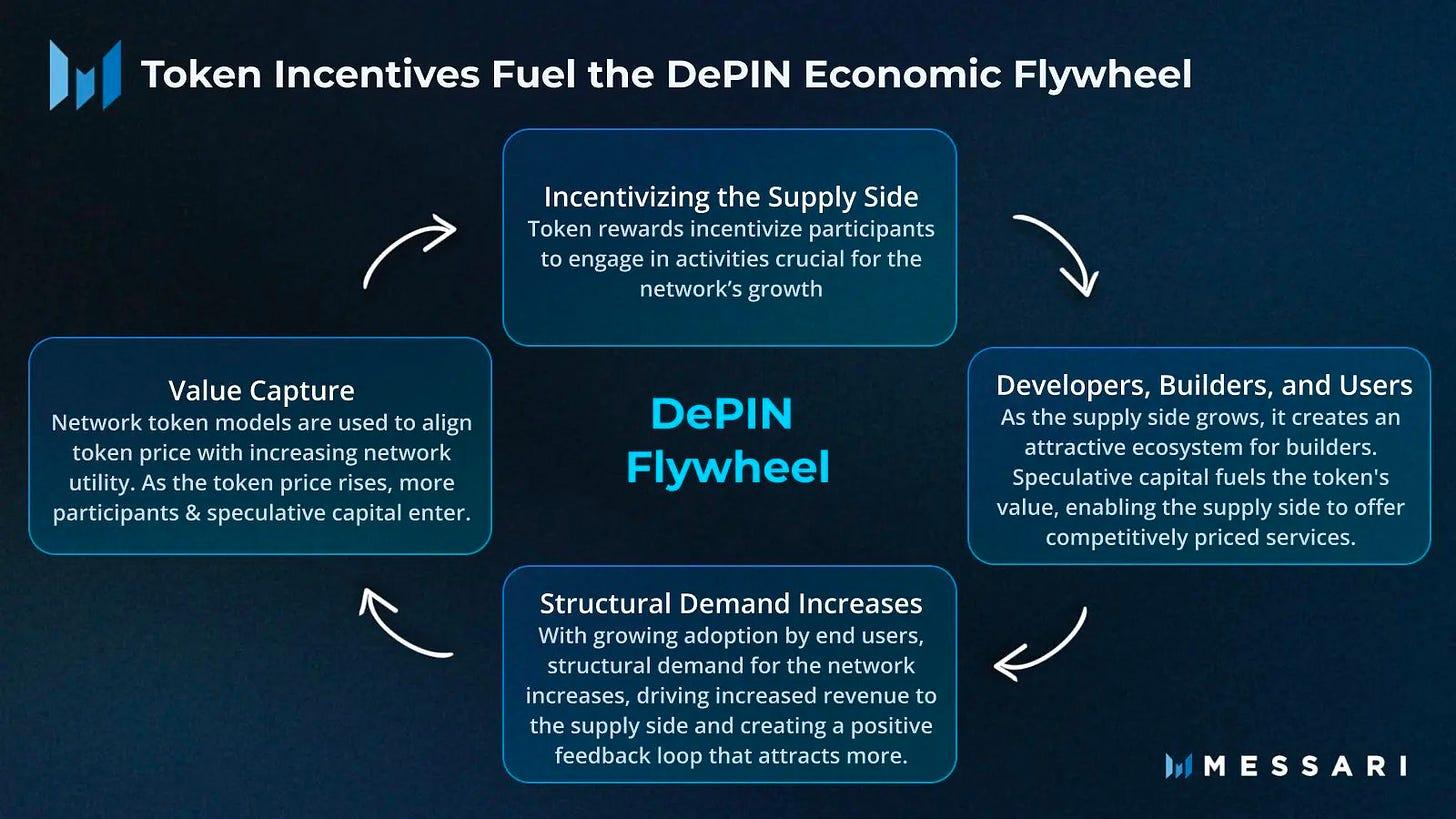

As the number of service providers grows and market demand increases, DePIN begins to form a "growth flywheel," continuously expanding its ecosystem while promoting self-sustaining development.

DePIN’s Revenue Model

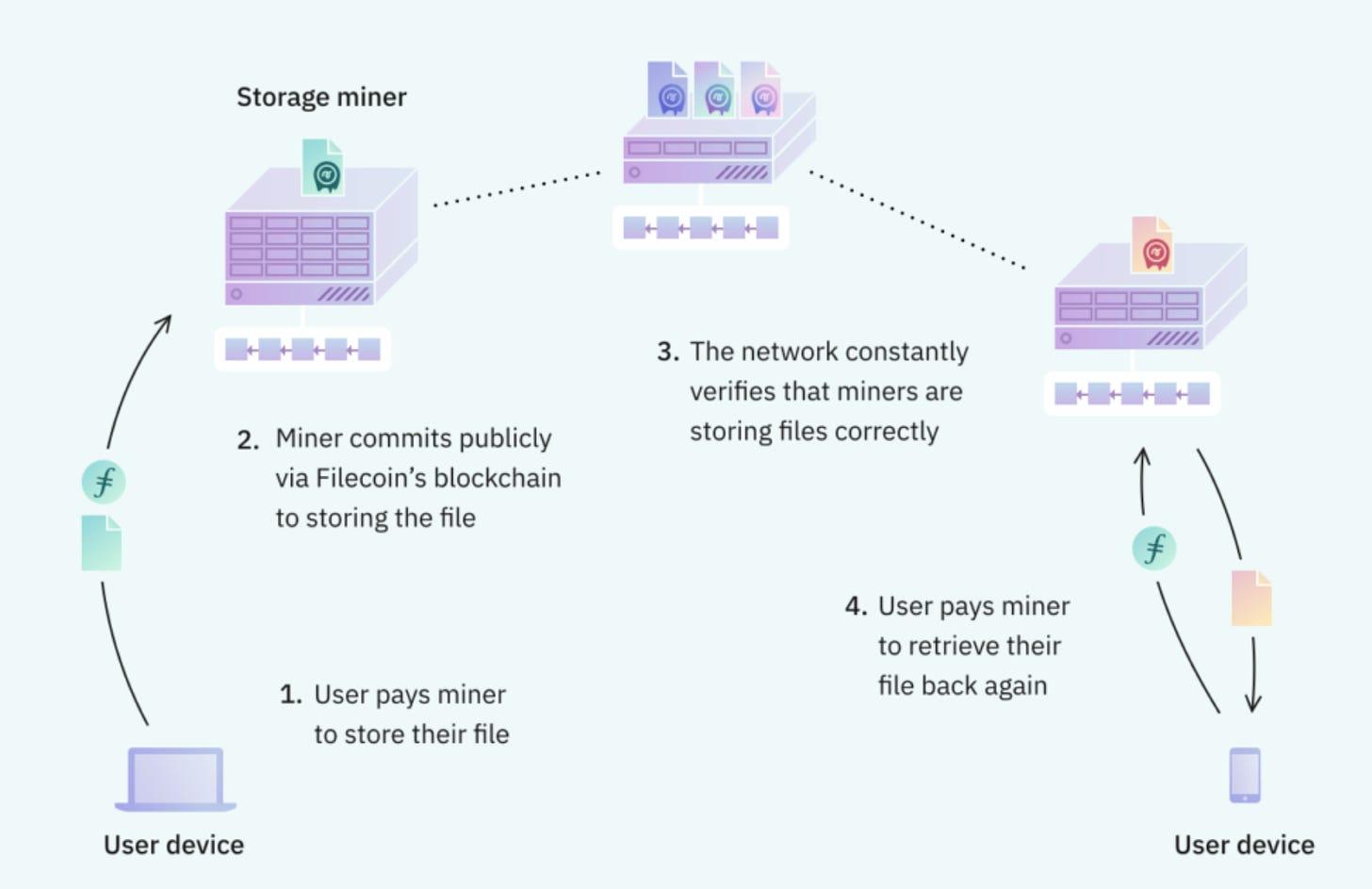

DePIN generates profit mainly through fees paid by service users. Users typically pay for services using tokens, creating economic flow. For example, decentralized storage services like Filecoin generate revenue through user payments in tokens, increasing token demand.

While different DePIN projects adopt various revenue strategies (some even selling hardware such as sensors), service fees remain the primary income source. This payment activity ensures DePIN projects’ continued growth while also driving token value.

Analysis of Key DePIN Tracks

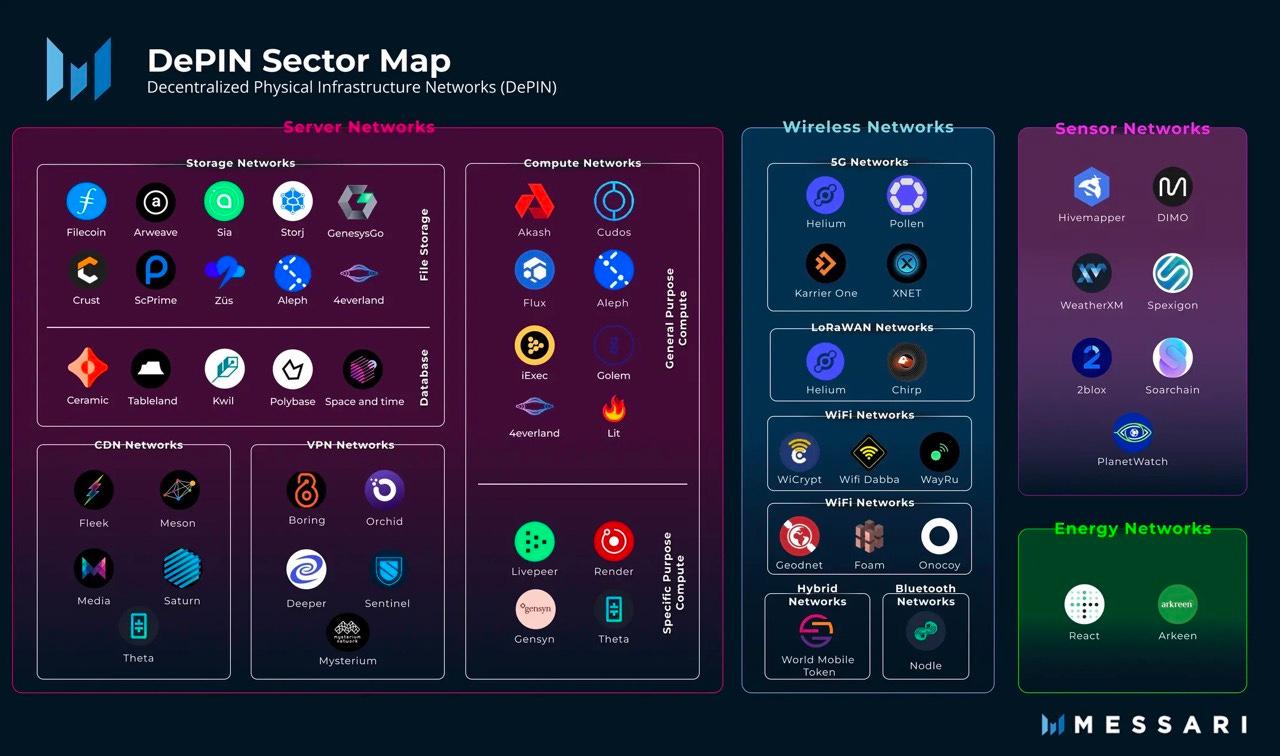

DePIN spans several fields and application scenarios. Below are the most popular tracks currently:

1. Storage Track

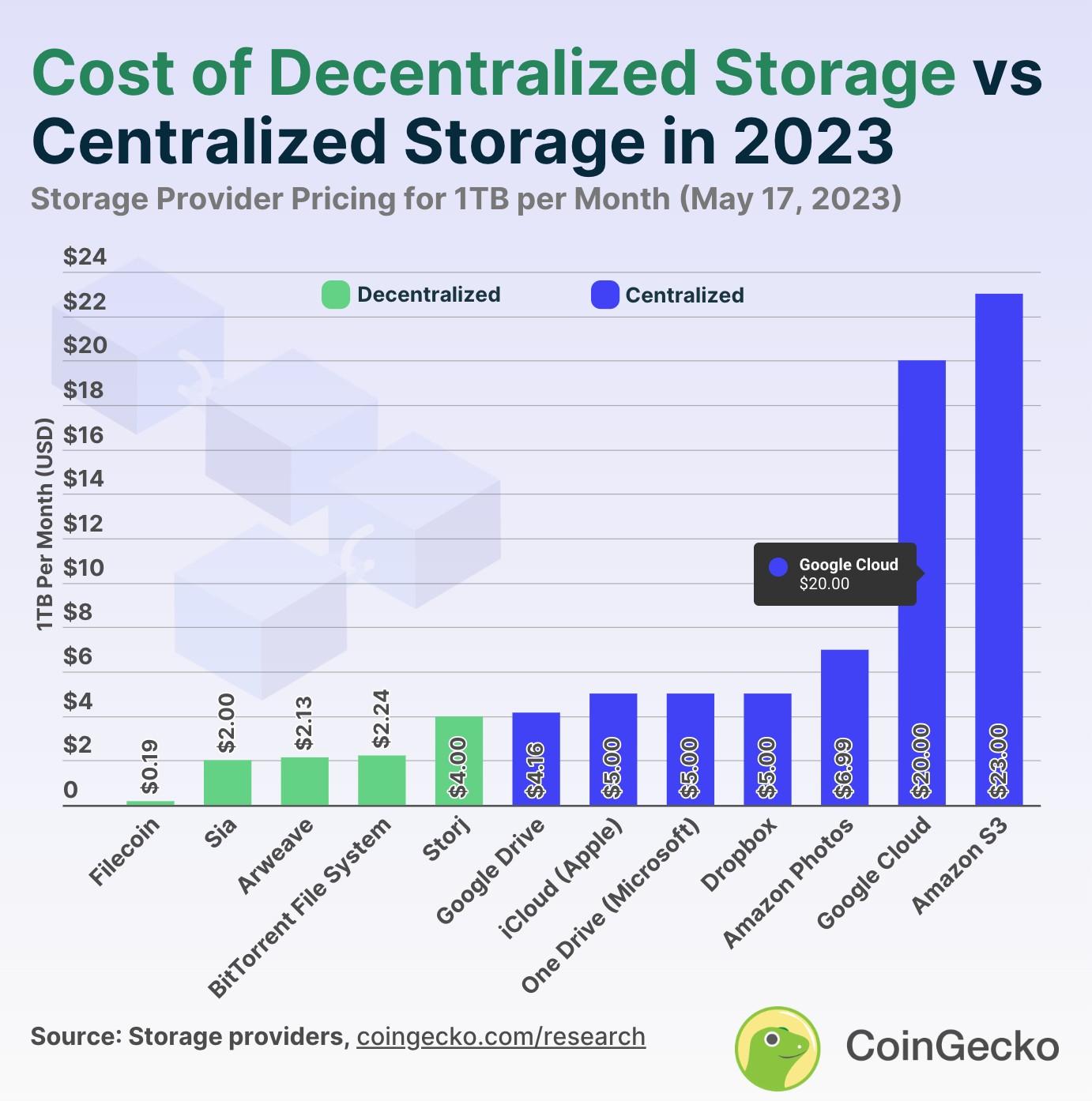

The storage track is one of the earliest DePIN applications, focusing on secure, efficient, and decentralized storage services. Decentralized storage ensures data safety while avoiding monopolization by a single centralized entity.

Representative Projects:

Filecoin ($FIL): Built on the IPFS system, it provides low-cost storage services while using blockchain to ensure data security.

Arweave ($AR): Specializes in one-time payment storage services, allowing users to store data permanently.

Storj ($STORJ): Utilizes satellite networks to provide distributed storage services targeted at commercial users.

While the storage market is widely accepted—particularly in enterprise-level markets—there is still room for market expansion.

2. Computing Track

This track aims to share idle computing power with users who need resources through decentralization. Applications include AI rendering, data analysis, blockchain mining, and more.

Representative Projects:

Render ($RNDR): Uses idle GPUs to provide rendering services, supporting film and animation production.

Livepeer ($LPT): Offers video transcoding services, optimizing costs for video streaming transmission.

Akash ($AKT): A decentralized cloud computing marketplace that allows users to lease CPU and GPU resources.

The demand for rendering and computing services has surged due to the increased need for AI technologies.

3. Wireless Network Track

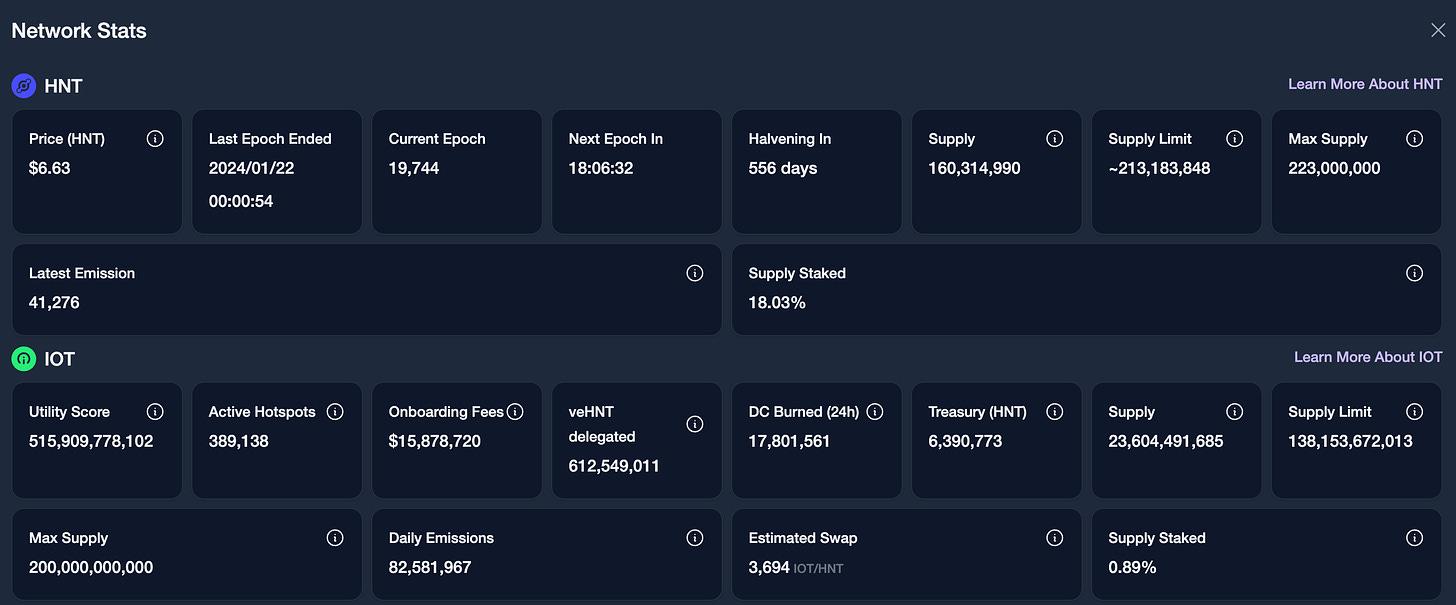

Wireless networks represent a critical DePIN application within the IoT (Internet of Things) space. Helium Network offers decentralized wireless network services by enabling user-shared devices to address IoT network shortages.

Representative Project:

Helium ($HNT): Users install network nodes to provide wireless network services and earn token rewards.

4. Sensor Track

The sensor track collects real-world data via sensors, consolidating it into a decentralized database for users requiring data analysis.

Representative Projects:

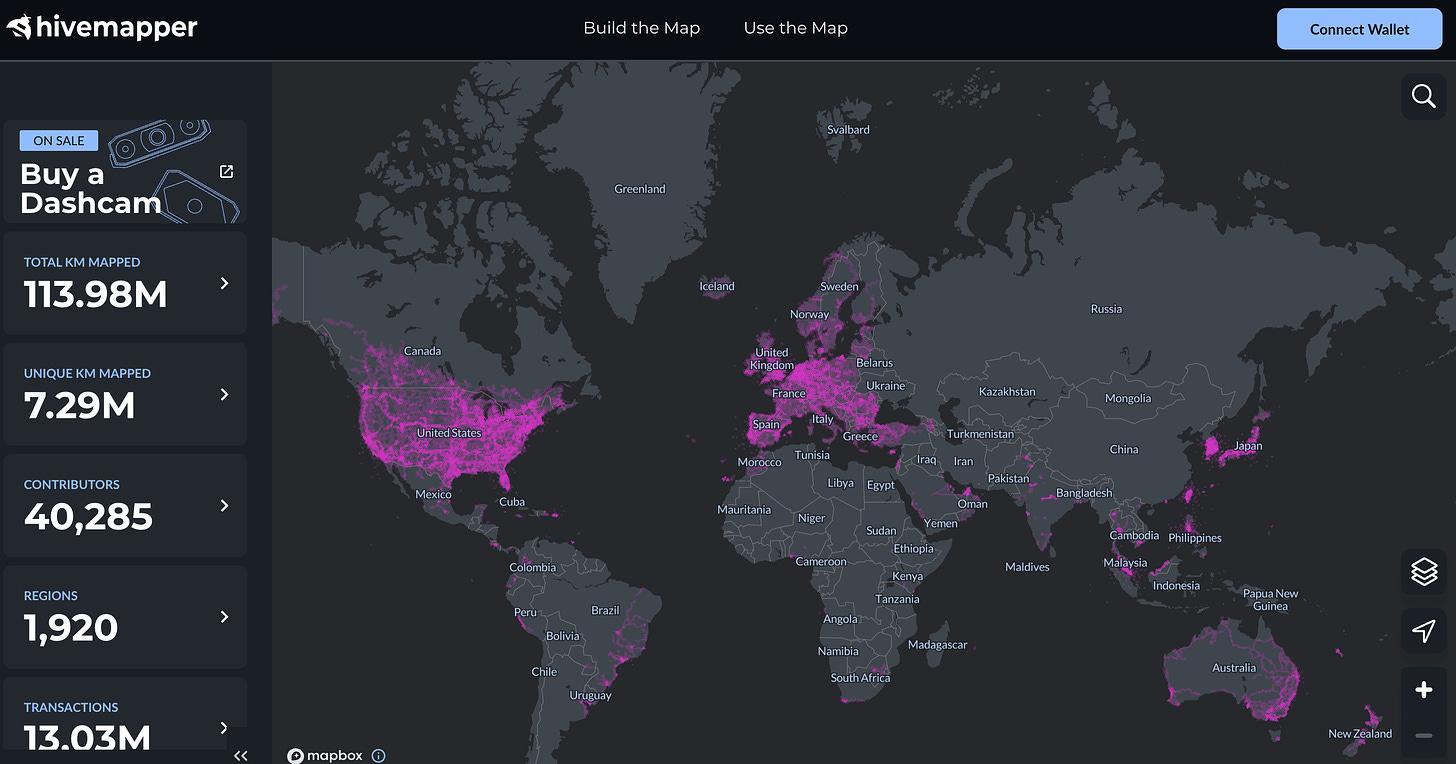

Hivemapper ($HONEY): Uses sensors mounted on vehicles to gather geographic data for real-time map updates.

DIMO ($DIMO): Specializes in sharing automotive sensor data, allowing users to sell their vehicle data to various companies.

These sensor services are increasingly vital in urban planning, smart transportation, and other industries.

Investment Analysis in DePIN Projects

Investment Recommendations

Focus on mature or active projects rather than purely speculative new ones to mitigate risk.

Prioritize leading projects with strong market competition.

Avoid participating in projects that could be classified as securities by regulatory bodies to reduce legal risks.

Investment Strategies:

Directly invest in specific DePIN project tokens.

Invest in leading tracks such as Filecoin for storage or Render for computing services.

Purchase tokens closely tied to key DePIN projects, sharing market growth potential (e.g., Solana ecosystem projects).

Conclusion:

DePIN represents not only technological innovation but also diverse market opportunities. Through strategic investment in various DePIN tracks, investors can participate in the decentralization wave, leveraging blockchain technologies and Web3 innovations while sharing technological growth dividends.

5.0 References

5.1 DePIN section panel:

DePIN Scan|DePIN Dashboard (by Messari)(https://messari.io/assets/depin)

Tags: DePIN, Decentralized Infrastructure, Blockchain Technology, Filecoin, Render