Annual review of the currency market: How will altcoins rewrite the market landscape in 2024?

summary:

Annual review of the currency market: How will altcoins rewrite the market landscape in 20...

summary:

Annual review of the currency market: How will altcoins rewrite the market landscape in 20... Annual review of the currency market: How will altcoins rewrite the market landscape in 2024?

2024: A Turning Point for the Cryptocurrency Industry

The year 2024 marks a pivotal moment for the cryptocurrency industry. The market exhibited a paradoxical dynamic: Bitcoin's stellar performance contrasted sharply with the stagnation or decline of most other tokens. However, by the end of the year, shifting regulatory policies introduced fresh opportunities for growth in the crypto market. This article delves into the cryptocurrency market's performance in 2024, explores the underlying factors, and provides a broader perspective.

Bitcoin Leads the Market Amid a Challenging Environment

In 2024, many investors pinned their hopes on the launch of spot Bitcoin ETFs, expecting them to invigorate market sentiment and drive prices to record highs. Early signs seemed promising: in the first quarter, Bitcoin's price surged over 50%, climbing to $73,000, accompanied by a significant inflow of capital. However, this optimism did not extend to other tokens, most of which remained lackluster or even experienced continued declines throughout the year.

Bitcoin’s Dominance Strengthens

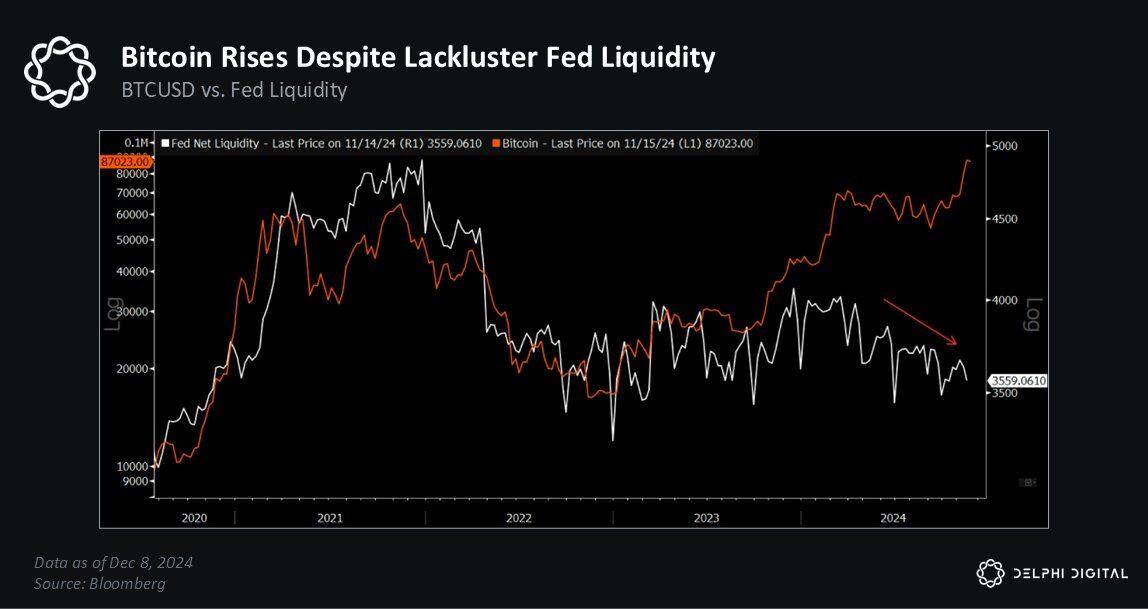

By the end of 2024, Bitcoin's market dominance reached its highest level in nearly three years, with prices increasing by more than 130% over the year. Despite headwinds from macroeconomic challenges and Federal Reserve monetary policy, Bitcoin's scarcity and its appeal to institutional investors solidified its position as the market's cornerstone.

A Remarkable Recovery in Market Prices

Entering 2024, major cryptocurrencies such as Bitcoin and Ethereum witnessed a significant rebound, with prices nearing all-time highs. Bitcoin's year-to-date increase of 130% pushed its market dominance to its highest point in three years. This trend not only underscored investors’ strong confidence in Bitcoin but also reinforced its role as digital gold.

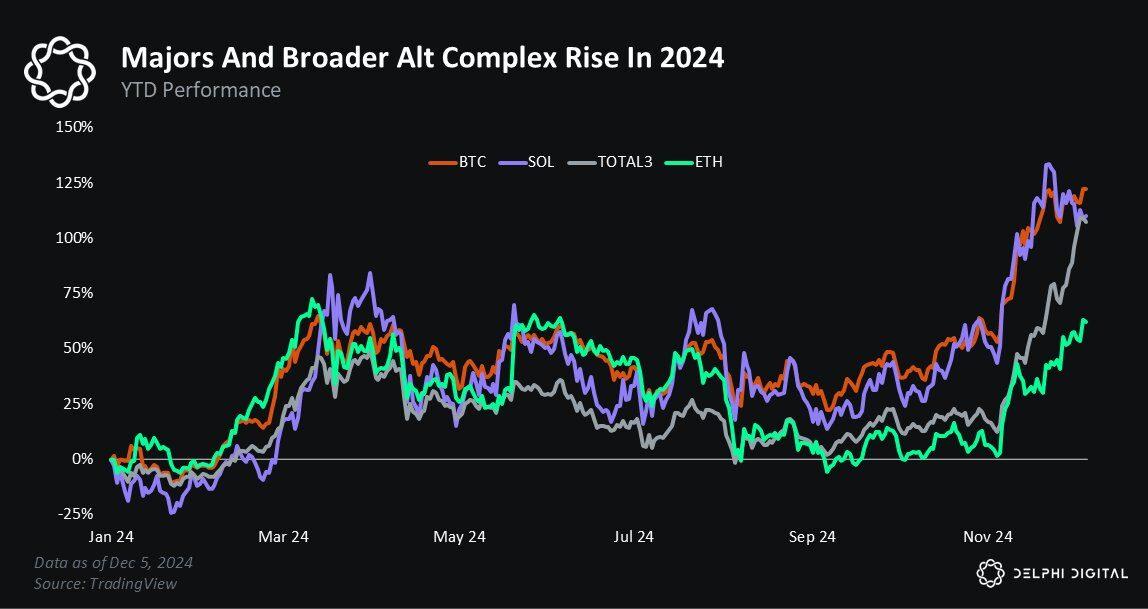

Meanwhile, the broader altcoin market showed mixed signs of recovery. Secondary cryptocurrencies like Solana and Chainlink experienced notable growth, but this was not indicative of a market-wide rebound. Many mid- and small-cap tokens remained stagnant or declined, leaving investors puzzled.

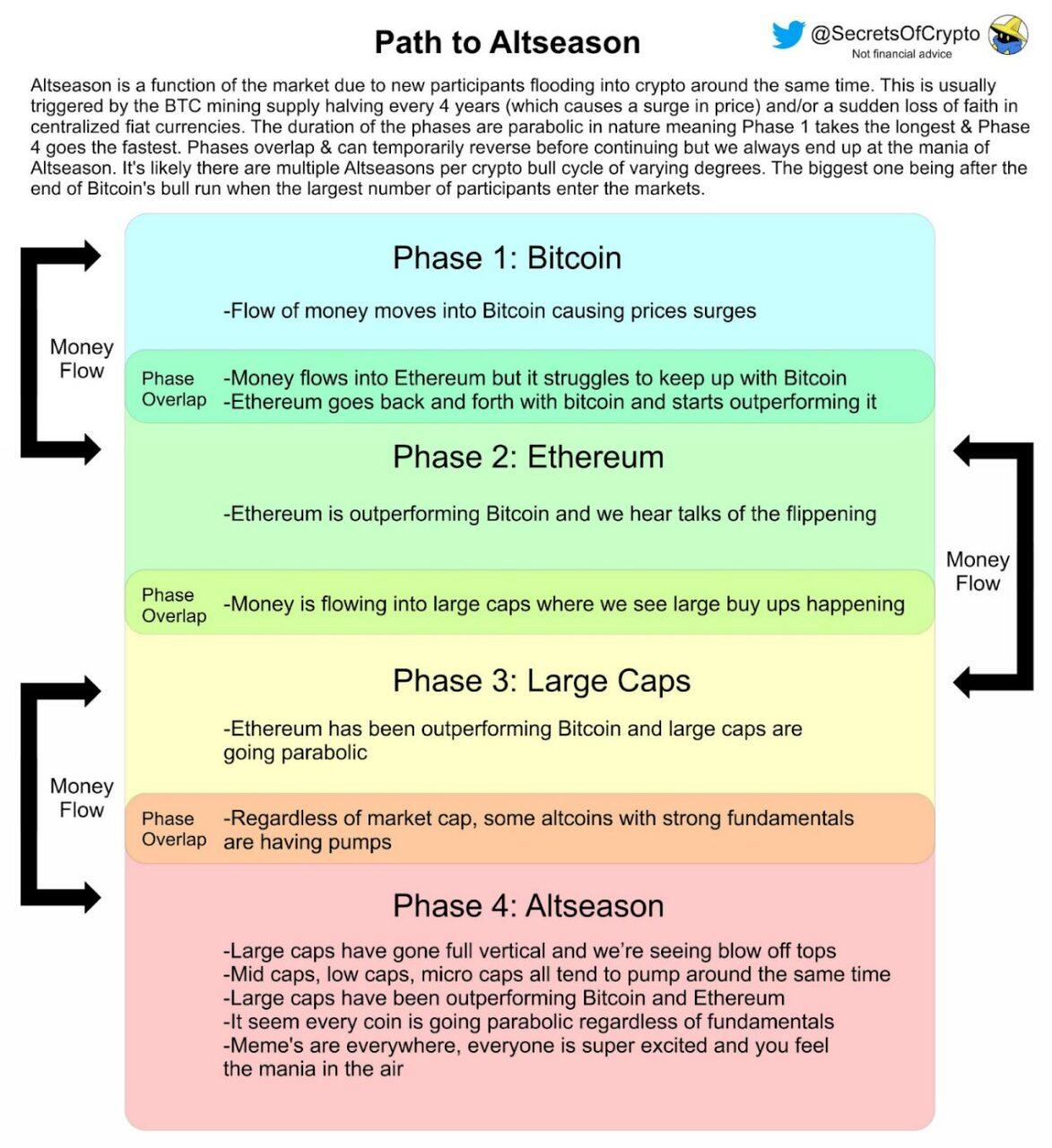

Historically, Bitcoin’s strong performance has often signaled the onset of an “altcoin season,” where smaller tokens see substantial gains. However, 2024 defied this pattern. Analysts attributed this deviation to dispersed liquidity and heightened risk aversion among investors.

Diverging Sentiments in the Crypto Community

Despite the overall price recovery, the mood within the crypto community was unusually subdued. This divergence was evident in discussions on social media platforms like Twitter, where debates centered on various topics, including token forecasts, blockchain applications, and regulatory policies.

The Impact of Bitcoin’s Dominance

Bitcoin's leadership played a critical role in shaping market sentiment and capital flow in 2024. Its market capitalization surpassed 50%, a milestone not seen since 2021. As Bitcoin strengthened, it attracted a greater share of capital as a "safe haven" asset, leaving other tokens struggling to secure liquidity.

Dispersed Capital Flows

Beyond Bitcoin’s dominance, the fragmentation of capital further fueled market disparities. Institutional investors began selectively allocating resources to specific blockchain applications, such as decentralized finance (DeFi) and non-fungible tokens (NFTs). This selective approach left many mid- and small-cap tokens underperforming, frustrating a segment of investors.

Internal conflicts also surfaced, such as debates over consensus mechanisms (e.g., PoW vs. PoS) and differing evaluations of emerging technologies, further exacerbating community divisions.

Supply-Demand Imbalance: A Core Issue

A growing supply-demand imbalance became increasingly apparent in 2024. The total number of tokens surpassed 10,000, a tenfold increase compared to 2017’s 1,500 tokens. This proliferation diluted market value and made it challenging for investors to profit from many alternative tokens.

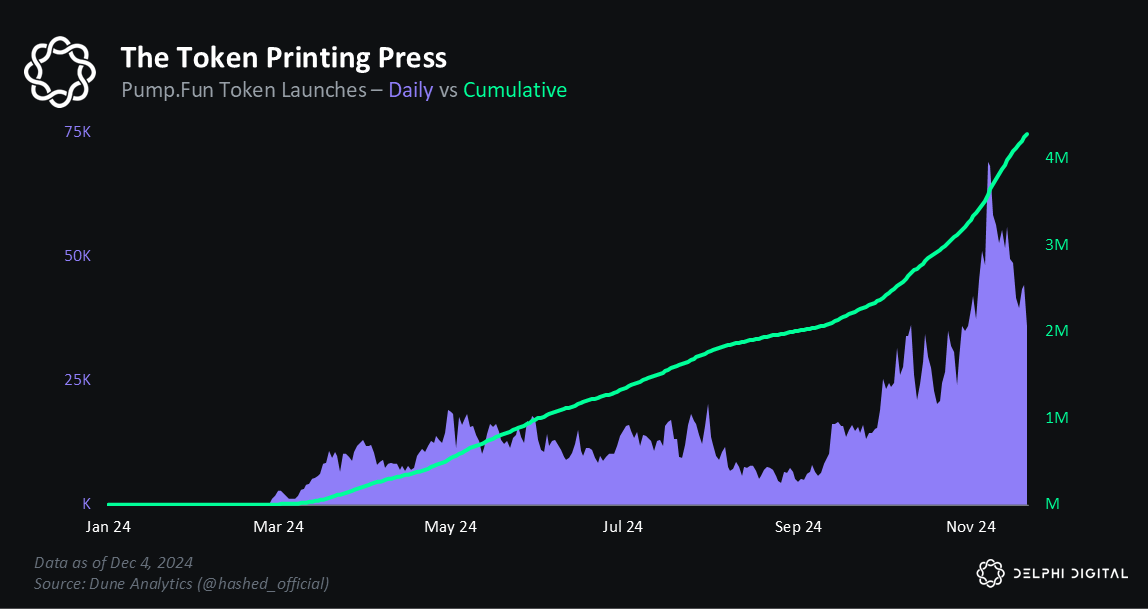

Uncontrolled Token Creation

Platforms like Pump.fun significantly lowered the technical barriers to token creation. Since January 2024, over 4 million new tokens have been launched, oversaturating the market and suppressing demand. This has led to liquidity challenges for many tokens.

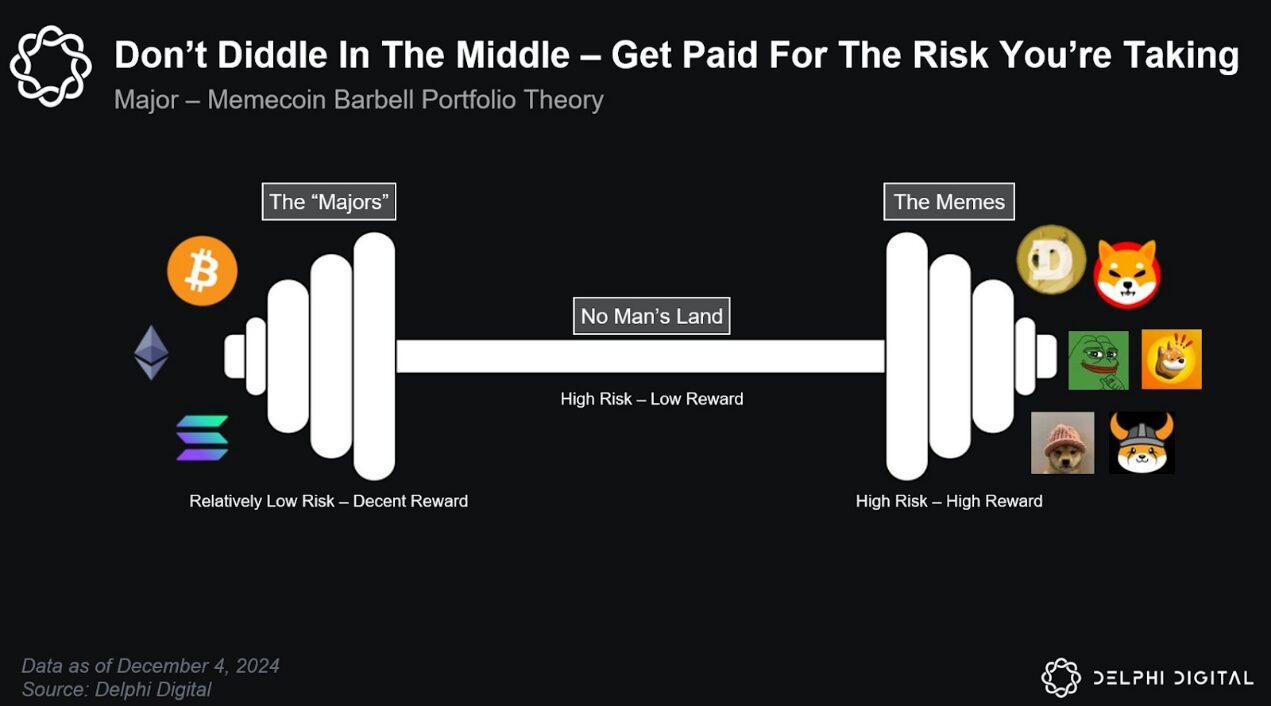

The Persistent Rise of Memecoins

Memecoins remained a focal point for speculators in 2024. Despite their high volatility and lack of fundamentals, these tokens attracted immense interest, further destabilizing the market. This phenomenon highlighted the short-term speculative tendencies of some investors over long-term value investment.

Ethereum vs. Solana: A Market Rivalry

Ethereum’s performance in 2024 was relatively subdued compared to Bitcoin. Despite launching network upgrades and new functionalities, Ethereum's liquidity growth remained slow, offering little momentum to the broader market.

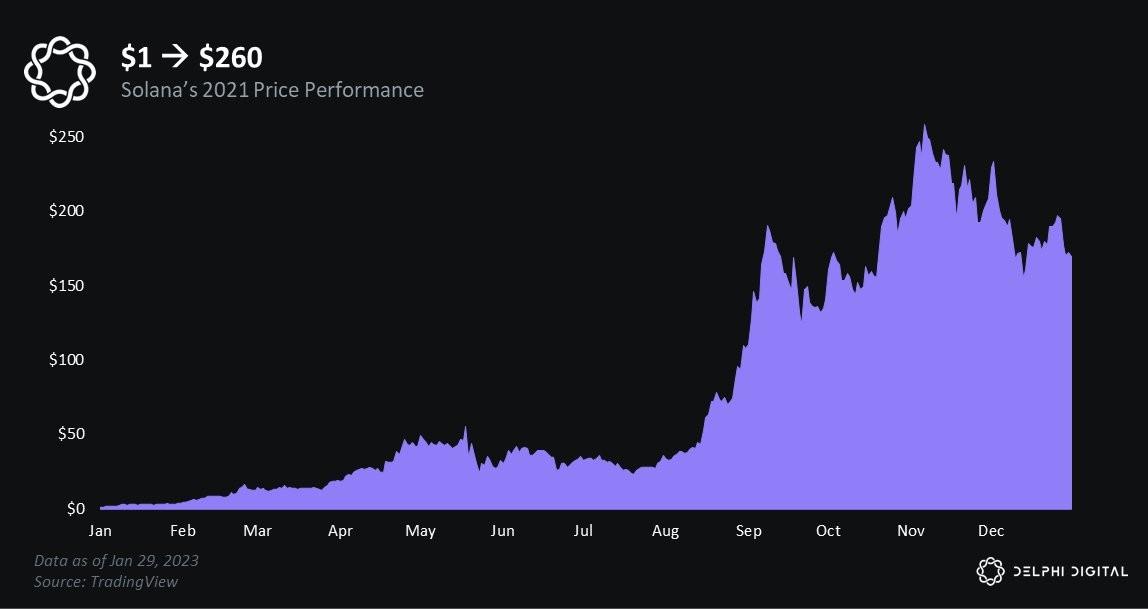

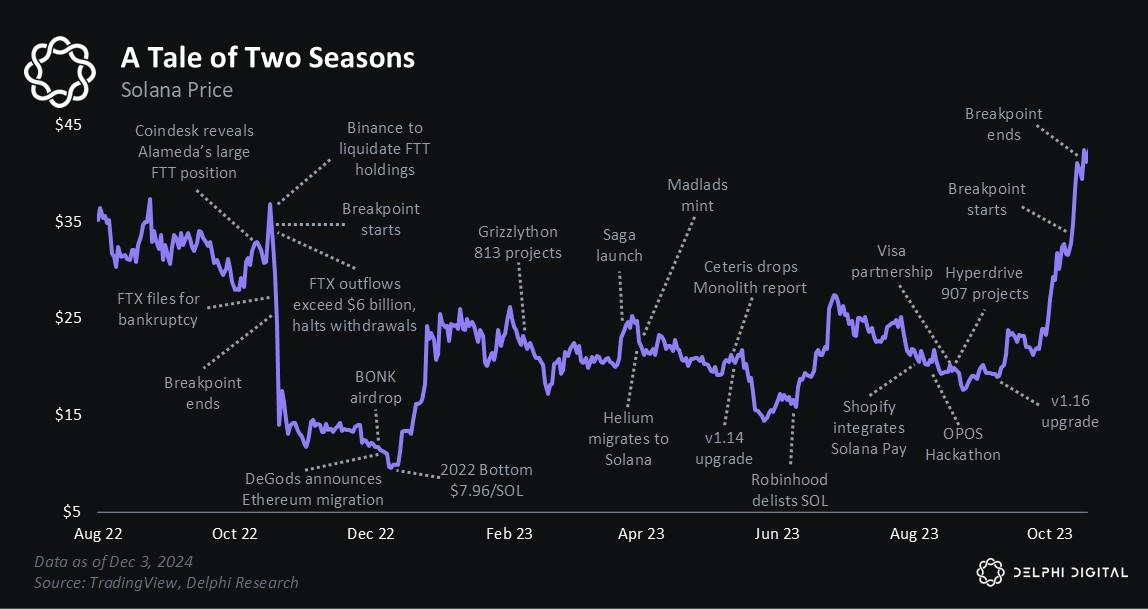

Solana’s Path to Recovery

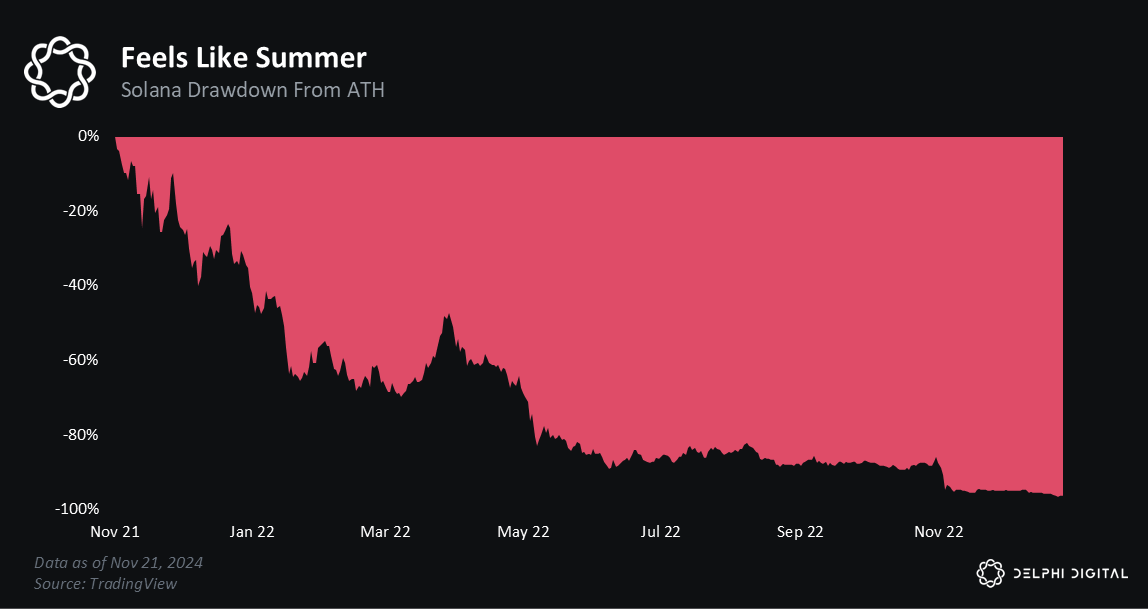

In contrast, Solana demonstrated a steady recovery throughout 2024. After hitting historic lows in 2022, Solana’s community rebuilt confidence through innovative initiatives. Key projects like Drift Protocol and Jito attracted new users and developers, fostering ecosystem growth.

Solana's past struggles, such as its 96% price drop following the FTX collapse and skepticism over its stability, gave way to a resurgence driven by strategic development.

However, Solana still faces challenges:

Can its price sustain long-term growth?

Will the memecoin frenzy pose risks to its ecosystem?

Can Ethereum’s counter-efforts weaken Solana’s position?

Nonetheless, Solana's core metrics indicate a strengthening ecosystem and increased competitiveness with Ethereum.

Macro Environment and Market Cycles

The cryptocurrency market in 2024 was deeply influenced by macroeconomic factors.

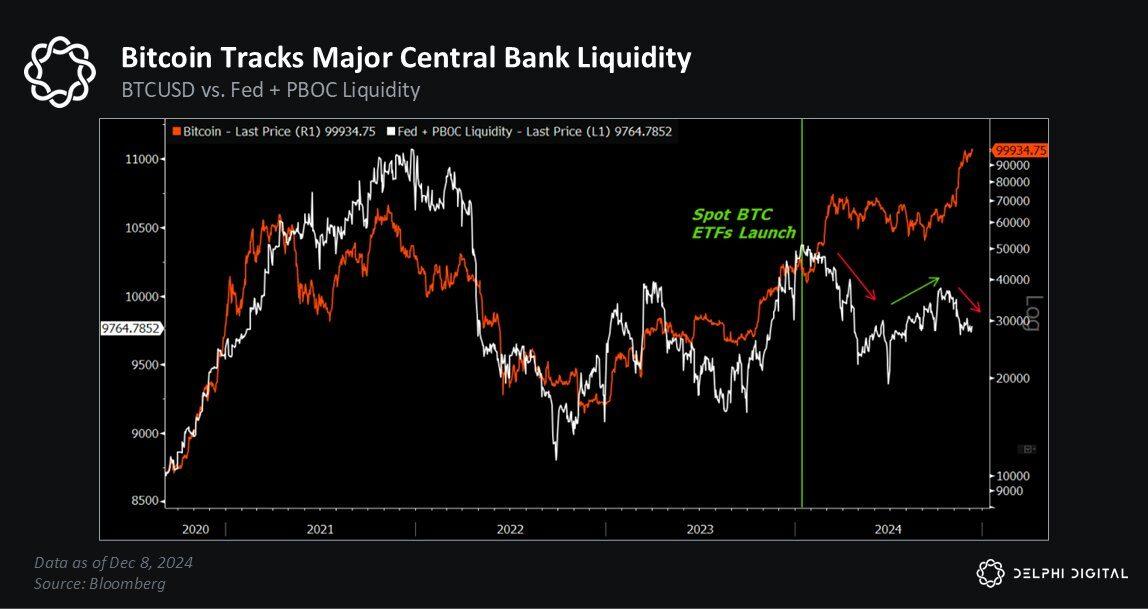

Liquidity Cycles

Global liquidity expansion was a key driver of market recovery. Delphi Digital had predicted that Bitcoin would perform strongly in the first quarter of 2024 due to rising global liquidity, and the forecast proved accurate. However, as liquidity growth slowed mid-year, the market entered a period of adjustment.

Policy and Regulation

The U.S. presidential election in November marked a turning point for the crypto market. The election outcome ushered in more favorable regulatory policies, boosting market risk appetite. This optimism contributed to a year-end rally in prices.

Outlook for 2025: The Start of a New Bull Market?

As 2024 draws to a close, market participants are optimistic about 2025. Key factors likely to shape the future include:

Institutional Participation: The widespread adoption of spot Bitcoin ETFs is expected to drive institutional investment, profoundly impacting the market.

Ecosystem Competition: The rivalry among Ethereum, Solana, and emerging blockchains will be crucial, with advantages in technology, efficiency, and user experience determining leadership in the next bull market.

DeFi and NFTs: Although these sectors lost some momentum in 2024, their long-term potential remains significant, especially with new applications on the horizon.

Memecoin Trends: Whether investors continue to favor memecoins or shift back to fundamentally strong assets will influence market direction.

Key Tags: Bitcoin ETF, Solana recovery, crypto supply-demand imbalance, memecoin frenzy, macro liquidity cycle