Bitcoin price surges to $100,000, DeFi ecosystem attracts global attention

summary:

Bitcoin price surges to $100,000, DeFi ecosystem attracts global attentionHere is the tran...

summary:

Bitcoin price surges to $100,000, DeFi ecosystem attracts global attentionHere is the tran... Bitcoin price surges to $100,000, DeFi ecosystem attracts global attention

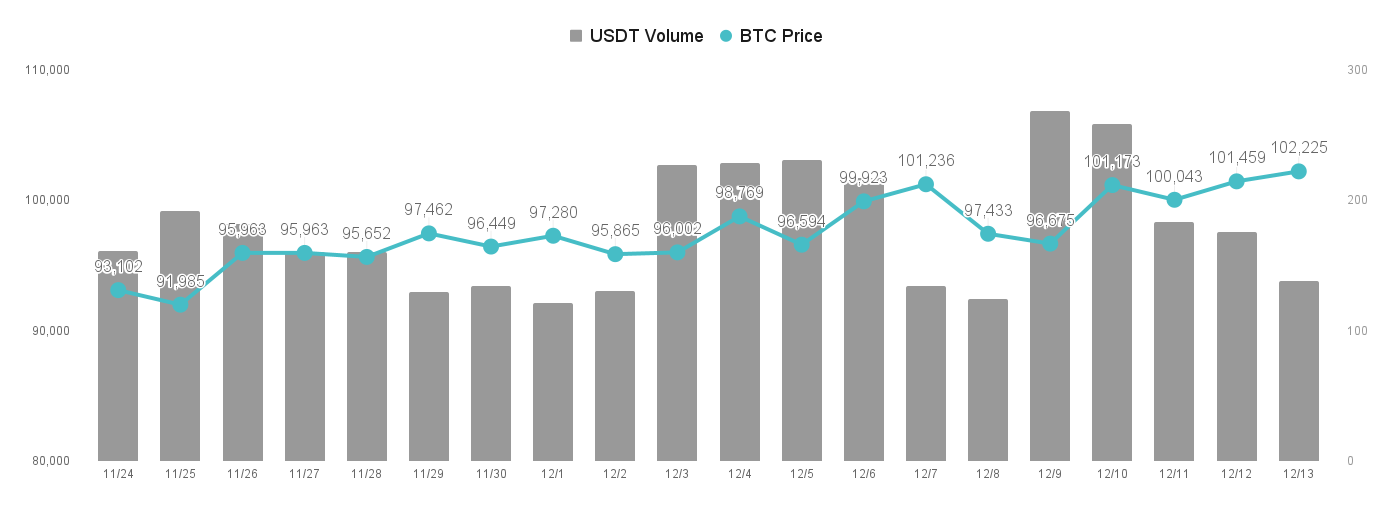

With the steady inflow of funds into spot Bitcoin ETFs (Exchange-Traded Funds), the cryptocurrency market is once again experiencing a high point. So far, Bitcoin has successfully surpassed the $100,000 mark and recently set a historic high of $106,000. Meanwhile, Ethereum has stabilized above the $4,000 mark. However, compared to mainnet cryptocurrencies (such as Bitcoin and Ethereum), the gains of DeFi-related tokens are more significant. Currently, market funds are flowing from mainnet cryptocurrencies into DeFi, with expectations of relaxed regulatory environments further driving this surge.

Spot ETF Boosting the Bitcoin Market

Bitcoin’s strong rebound is closely tied to the inflow of funds into spot ETFs. Last week, Bitcoin ETF saw net inflows exceeding $200 million on four consecutive days, with Friday seeing a slight slowdown. This highlights the strong demand from institutional investors, particularly driven by the cryptocurrency-friendly policies of former U.S. President Trump. Additionally, the U.S. November CPI growth rate remains at 2.7%, indicating relatively manageable inflation, maintaining a stable macroeconomic environment supportive of cryptocurrencies.

Large asset management companies like BlackRock are actively participating in the cryptocurrency market. Their suggestion for investors to allocate 2% of multi-asset portfolios into Bitcoin further bolsters confidence in the market for digital assets. So far, U.S.-launched Bitcoin ETFs have cumulatively attracted over $50.5 billion in inflows, serving as a key driver for Bitcoin's price surge. On the corporate front, companies like MicroStrategy continue to increase their long-term investment in Bitcoin. This week alone, they purchased an additional 21,550 BTC at an average price of $98,782, bringing their total holdings to 423,650 BTC.

Bitcoin Market Expansion: DeFi Tokens Seizing Opportunities

As the Bitcoin ETF market matures, more funds are flowing from mainnet cryptocurrencies like Bitcoin and Ethereum into DeFi-related tokens. Recently, DeFi token prices have surged significantly more than the overall market, especially amid favorable expectations of regulatory loosening. The rise of the DeFi market benefits not only from technological innovation but also from both policy relaxation and increased institutional involvement.

U.S. Securities and Exchange Commission (SEC) Commissioner Hester Peirce recently emphasized the need to lift restrictions on the cryptocurrency industry and promote a clearer regulatory framework. She advocates for ending the "Chokepoint 2.0" policy, allowing banks to offer custody and financial services to cryptocurrency companies, which would further activate market vitality. Additionally, she highlighted the need for defining the securities attributes of cryptocurrencies, reducing unnecessary regulatory barriers, which will directly benefit the development of DeFi tokens.

The SEC’s call for regulatory relaxation, coupled with a shift in economic policies from major global countries, is rapidly increasing the appeal of DeFi-related tokens. For instance, DeFi projects like Chainlink (LINK) and Aave (AAVE) have seen prices rise by over 50% in recent weeks, with institutional investments playing a significant role.

National Strategic Reserves: Bitcoin as a Focus

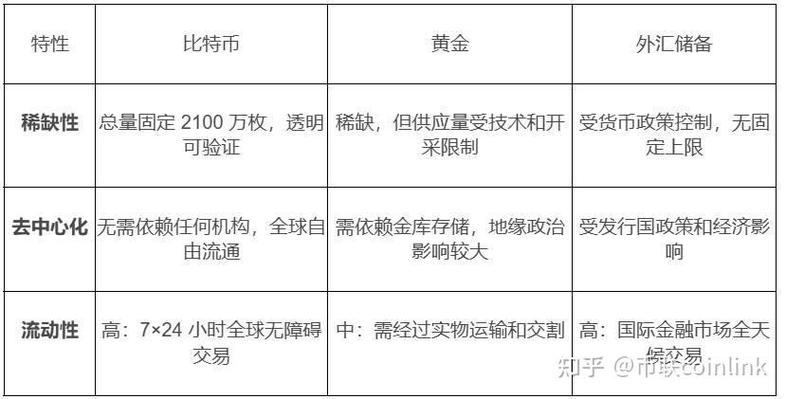

Binance’s former CEO, Zhao Changpeng (CZ), stated at the Bitcoin MENA conference in Abu Dhabi that countries, including China, may begin building strategic reserves of Bitcoin. He believes that smaller nations might lead by adopting Bitcoin as a national reserve asset, which could have a profound impact on the global economic landscape. CZ pointed out that Bitcoin’s scarcity and anti-inflation characteristics could make it a global "hard asset," with larger nations like China potentially storing Bitcoin before announcing policies to minimize market volatility.

Furthermore, Bridgewater Associates founder Ray Dalio has publicly urged investors to abandon traditional debt assets and instead invest in hard assets, including Bitcoin. He emphasized that the global economy is facing an unprecedented debt crisis, causing the appeal of debt assets to decline, while Bitcoin, with its limited supply and risk-hedging capabilities, becomes an ideal long-term investment.

WLFI and DeFi Projects Driving Innovation

World Liberty Financial (WLFI), under the Trump family, has recently injected substantial funds into DeFi projects, drawing widespread attention. After receiving investment from Tron founder Sun Yuchen, WLFI shifted from a traditional lending platform to a crypto asset investment firm, quickly expanding into Ethereum (ETH), Chainlink (LINK), and Aave (AAVE) DeFi tokens.

Although the investment amount is relatively small, the policy signal it represents is significant. The market generally anticipates that the U.S. government may adopt more relaxed DeFi regulatory policies in the future, thereby further stimulating demand for DeFi tokens. According to Santiment, LINK’s recent price surge is closely tied to whale accumulation, with the number of wallets holding over 100,000 LINK significantly increasing, indicating strong institutional support for the project.

In addition to WLFI’s funding, the DeFi market continues to benefit from ongoing technological innovation. Chainlink’s price oracles and cross-chain technology are providing essential support for decentralized exchanges. Meanwhile, Aave’s v3 version enhances the efficiency and scalability of DeFi protocols.

Capital Rotation and Future Outlook

Currently, the cryptocurrency market is experiencing a noticeable rotation of funds, with capital flowing from mainnet cryptocurrencies to DeFi tokens. Beyond LINK and AAVE, native tokens of decentralized exchanges like Uniswap have also seen significant price gains recently. As more regulatory frameworks are implemented and macroeconomic conditions improve, the growth potential for the DeFi market is expected to further expand.

Overall, the stable inflow of funds into spot Bitcoin ETFs provides a solid foundation for the market, and with the rise of DeFi, the cryptocurrency market is entering a new phase of growth. In the future, the flow of funds between mainnet cryptocurrencies and DeFi tokens will be a key focus, with investors advised to closely monitor regulatory developments and institutional investments to seize potential investment opportunities.

Keyword Tags: Bitcoin ETF, DeFi Tokens, Regulatory Relaxation, Capital Rotation, Decentralized Finance