Predictions for 2025: Bitcoin expected to surge to $180,000, Ethereum targets $6,000

summary:

Predictions for 2025: Bitcoin expected to surge to $180,000, Ethereum targets $6,0002024 C...

summary:

Predictions for 2025: Bitcoin expected to surge to $180,000, Ethereum targets $6,0002024 C... Predictions for 2025: Bitcoin expected to surge to $180,000, Ethereum targets $6,000

2024 Cryptocurrency Market Recap and Top 10 Predictions for 2025

2024 was a significant year for the cryptocurrency market. Despite experiencing high volatility, numerous key events and trends paved the way for new developments in the global digital asset industry. In this year, Bitcoin (BTC) surpassed $100,000, and Ethereum (ETH) reached over $4,000, outperforming many investors' expectations. However, predicting market trends remains challenging, with a prediction accuracy of 56.6% for 2024. Here are some key trends observed:

BTC Spot ETF Debuts

Bitcoin successfully completed its halving event.

Ethereum maintained its position as the second-largest cryptocurrency.

Stablecoin market capitalization hit historical highs.

Decentralized exchanges (DEXs) saw record-high trading volumes.

Solana (SOL) outperformed Ethereum in terms of performance.

These milestones indicate the further maturation of the cryptocurrency market and lay the groundwork for developments in 2025. Let’s dive into the top 10 key predictions for 2025 and explore the future trajectory of the cryptocurrency industry.

1. Bull Market Peaks in 2025

The cryptocurrency bull market is expected to continue into 2025. Bitcoin may reach a peak of $180,000 in the first quarter, while Ethereum could surpass $6,000. Other top-performing projects like Solana and Sui may touch $500 and $10, respectively. However, after hitting these highs, the market may experience significant corrections. Bitcoin could see a 30% decline, while altcoins may face a 60% pullback. As the market recovers in the autumn, mainstream tokens are expected to rise again and set new all-time highs by the end of the year. Investors should monitor key signals such as:

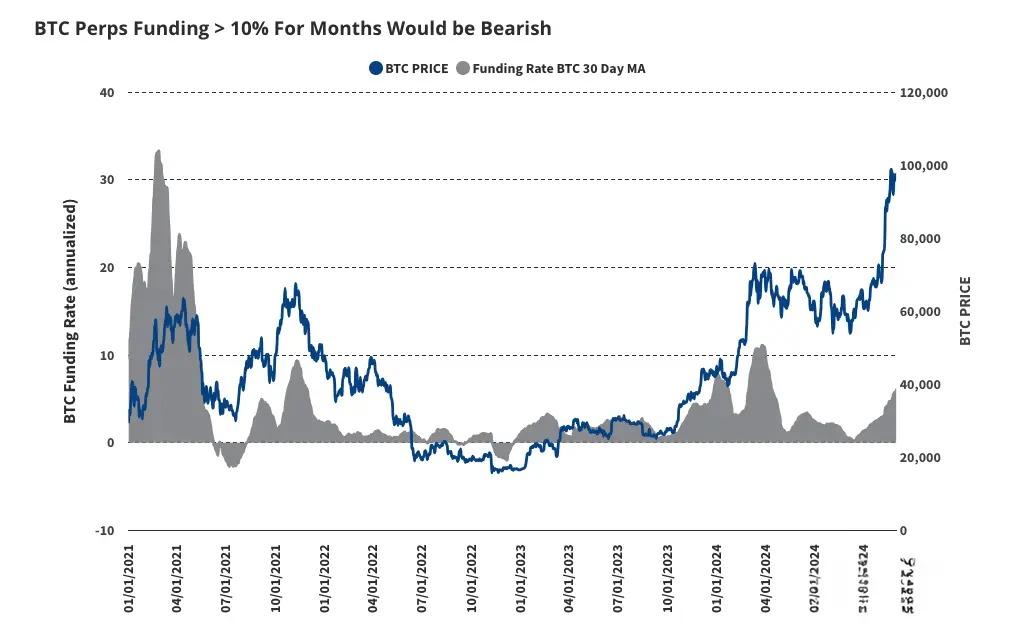

High funding rates: If BTC perpetual contract funding rates remain above 10%, the market could become overly speculative.

Excessive unrealized gains: If holders maintain a profit ratio of over 70%, the market risks overheating.

Declining Bitcoin dominance: A drop below 40% in BTC market share indicates more capital flowing into riskier altcoins.

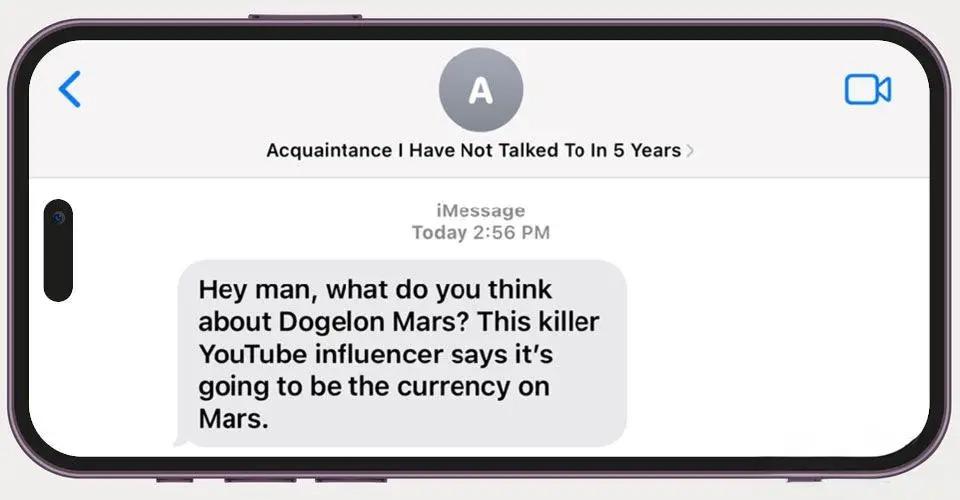

FOMO-driven trends: Increased public interest in specific cryptocurrency projects often signals a market peak.

2. U.S. Embraces Bitcoin and Strategic Reserves

On the policy front, 2025 could see the U.S. adopting Bitcoin through legislation or executive orders to integrate it into national strategic reserves. Following pro-crypto policies, states like Texas and Florida, which are crypto-friendly, may begin accumulating BTC to hedge against fiscal risks. Additionally, approval and expansion of cryptocurrency exchange-traded products (ETPs) will become a major focus. The SEC may endorse Ethereum-based ETP staking, further driving the integration of crypto assets into traditional financial systems.

3. Tokenized Securities Market Hits $50 Billion

Tokenized securities are poised to be a key growth area in 2025. The current on-chain tokenized asset market, valued at $12 billion, is expected to grow to $50 billion next year due to several driving factors:

Institutional adoption: Institutions like DTCC will support the flow of tokenized assets between public and private blockchains.

Increased efficiency: Blockchain technology enhances transparency and automation in securities markets.

Innovative use cases: Coinbase, for instance, could tokenize its stock COIN and deploy it on the BASE network, marking a significant milestone in capital markets.

4. Stablecoin Daily Settlement Volume Hits $300 Billion

Stablecoins are rapidly expanding beyond crypto trading, playing a key role in cross-border payments, remittances, and commercial transactions. By 2025, we predict stablecoin daily settlement volumes will reach $300 billion, equivalent to 5% of the current U.S. securities settlement system (DTCC). Key drivers include:

Cross-border remittance growth: For instance, remittances from the U.S. to Mexico could increase from $8 billion to $40 billion.

Tech giants entering the space: Companies like Apple, Google, and Visa will accelerate global stablecoin adoption.

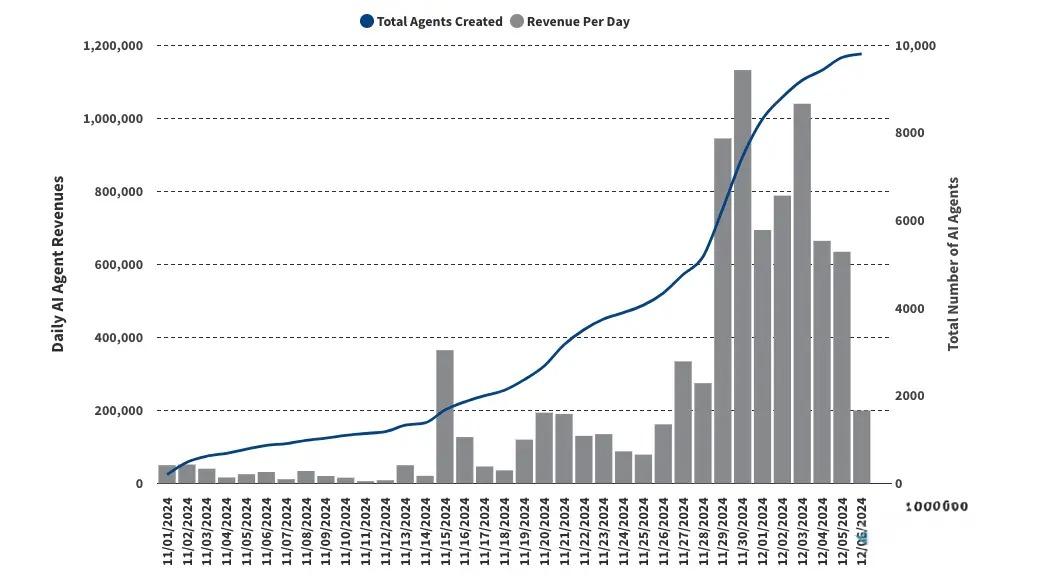

5. AI-Powered Agents on the Blockchain Exceed 1 Million

The convergence of AI and blockchain is set to create new market opportunities, particularly in decentralized finance (DeFi). AI-powered agents, capable of autonomous decision-making, will optimize investment returns and automate tasks. Beyond finance, AI agents will expand into social media, gaming, and consumer applications. By 2025, we expect the number of AI-powered agents on the blockchain to exceed 1 million, becoming an integral part of the blockchain ecosystem.

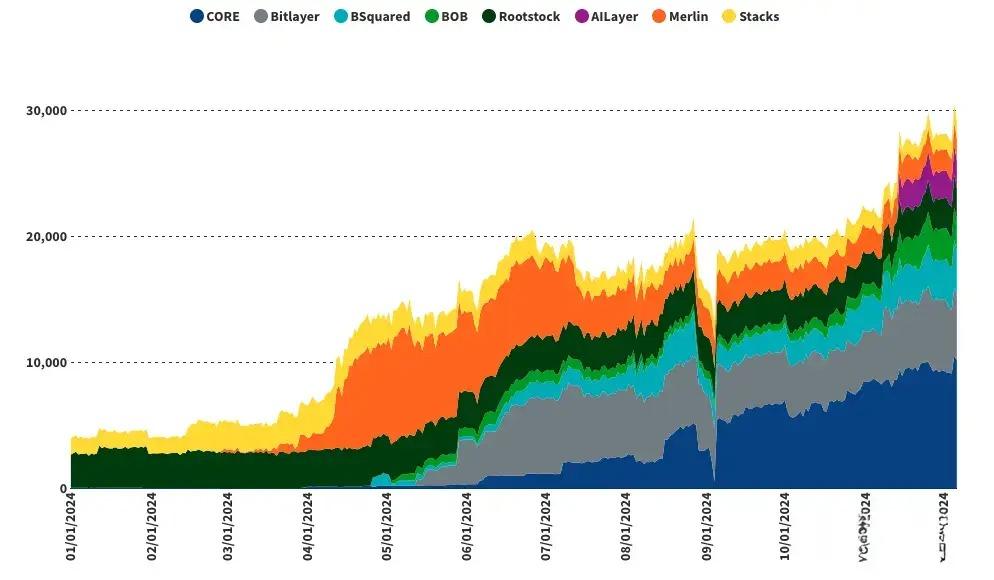

6. Bitcoin Layer 2 TVL Reaches 100,000 BTC

As demand for Bitcoin network scalability grows, Layer 2 solutions will achieve significant milestones in 2025. These solutions will increase throughput and reduce transaction costs, potentially bringing Bitcoin’s total value locked (TVL) to 100,000 BTC. Layer 2 networks will also introduce smart contract functionality, further enhancing Bitcoin’s DeFi ecosystem and increasing on-chain activity.

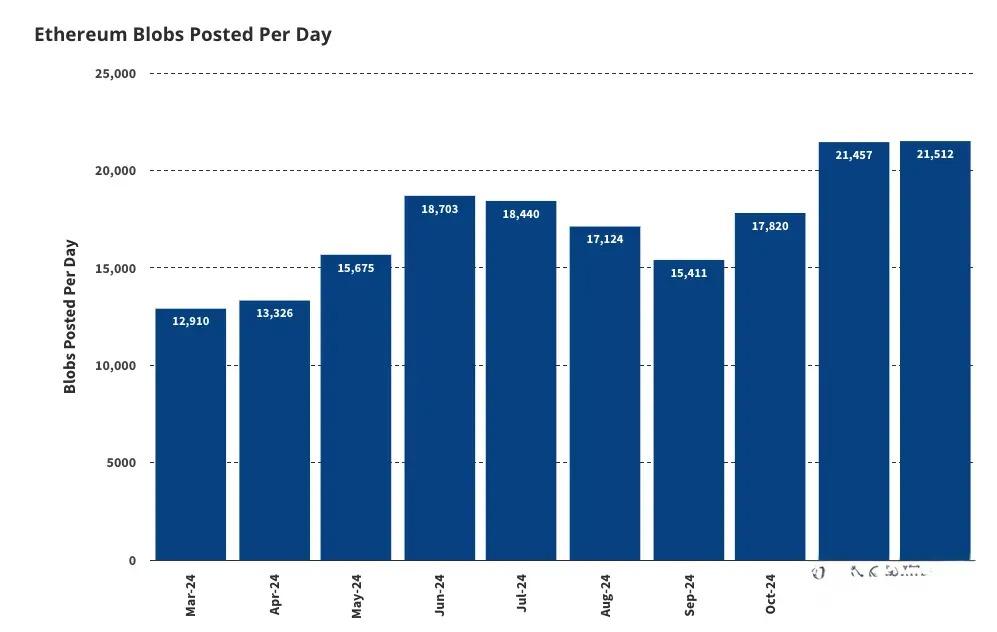

7. Ethereum Blob Technology Generates $10 Billion in Fees

Ethereum’s Layer 2 ecosystem will continue its rapid growth in 2025, with Blob technology optimizing data storage and reducing transaction fees. This will attract more developers and users, generating $10 billion in fee revenue.

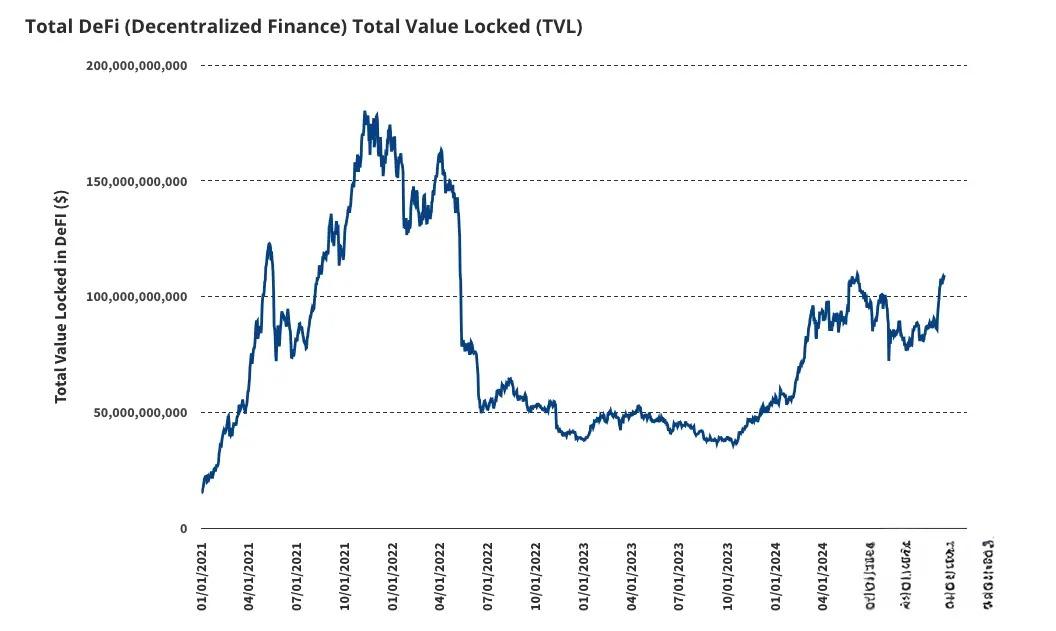

8. DeFi Total Locked Value Surpasses $200 Billion

Decentralized Finance (DeFi) will experience explosive growth in 2025. The trading volume of decentralized exchanges (DEXs) could exceed $4 trillion, while DeFi’s total value locked (TVL) may surpass $200 billion. This growth reflects the massive influx of capital from traditional finance into the blockchain world, driven by high yields and innovative financial services.

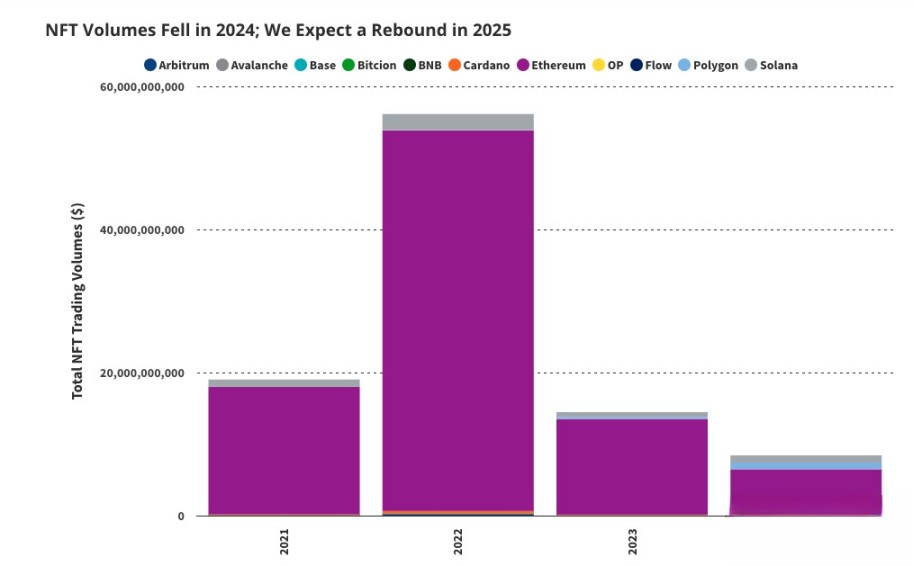

9. NFT Market Rebounds to $30 Billion

After a period of adjustments, the NFT market is expected to recover in 2025. Innovations in gaming, art, and virtual real estate will drive NFT transactions to $30 billion. Blue-chip NFT projects will continue to lead the market, while new platforms and projects will further expand the NFT ecosystem.

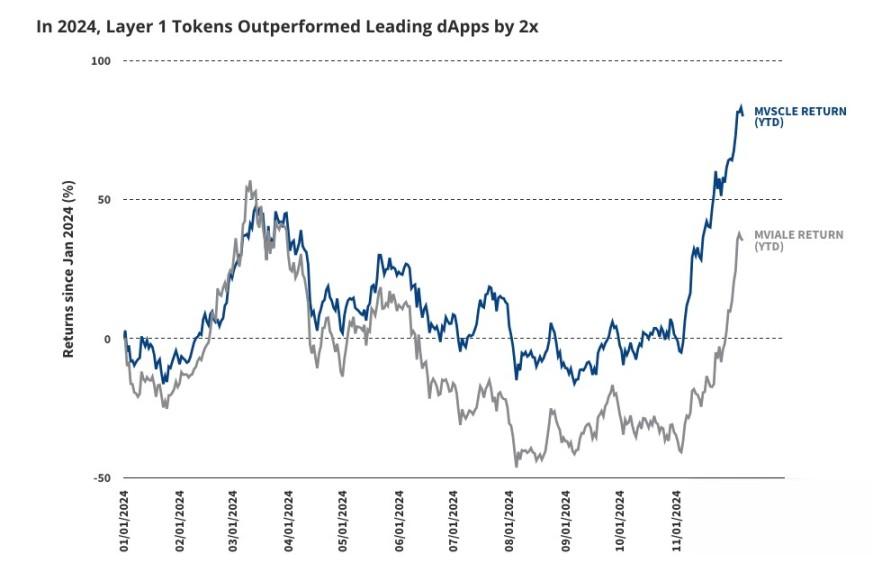

10. DApp Token and Layer 1 Token Performance Gap Shrinks

As blockchain applications mature, the performance gap between DApp tokens and Layer 1 network tokens will narrow. This reflects the growth of application layers and increased user adoption, paving the way for more practical use cases and investment opportunities in DApps across various sectors like finance, social media, and gaming.

Keywords: Cryptocurrency Predictions, Bitcoin Bull Market, Stablecoin Growth, Tokenized Securities, AI Blockchain