Bitcoin heading towards $100,000: Are the signs of the next bull market breaking out?

summary:

Bitcoin heading towards $100,000: Are the signs of the next bull market breaking out?In re...

summary:

Bitcoin heading towards $100,000: Are the signs of the next bull market breaking out?In re... Bitcoin heading towards $100,000: Are the signs of the next bull market breaking out?

In recent years, the cryptocurrency market has attracted increasing attention, particularly the volatility and trends of mainstream digital assets like Bitcoin, which have gained the interest of investors and market researchers alike. According to analysis from Grayscale Research, the current cryptocurrency market is in the "mid-cycle" phase of a bull market. As long as the fundamentals remain strong—such as the widespread adoption of technological applications and improvements in the global economic environment—the current bull market may persist until at least 2025 or longer.

Bitcoin’s Four-Year Cycle and Historical Patterns

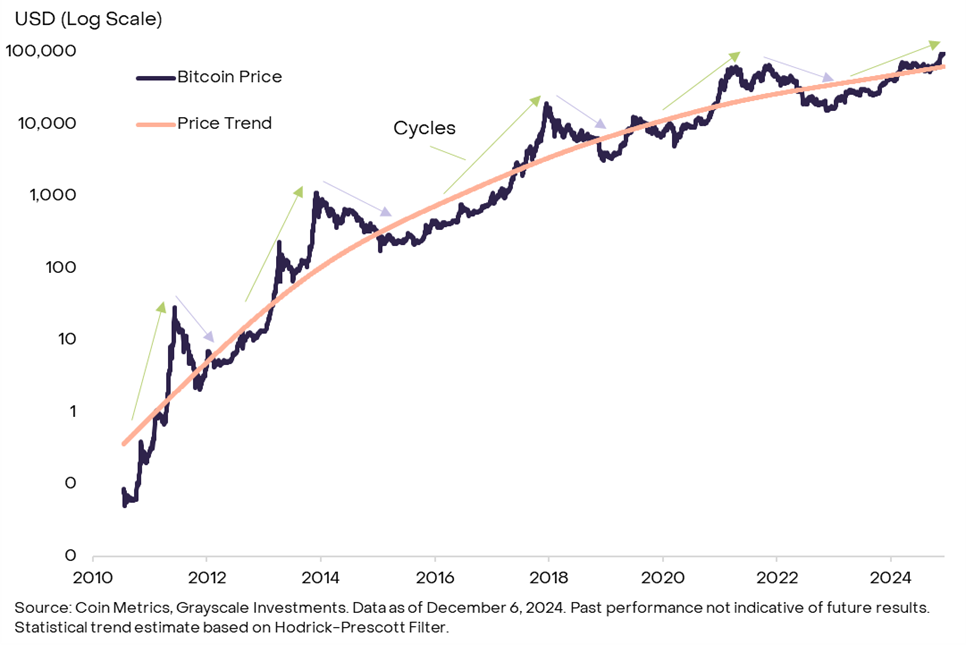

Historically, Bitcoin and the cryptocurrency market have shown clear cyclical patterns, typically occurring in four-year cycles closely tied to Bitcoin’s halving mechanism. Each cycle typically includes phases of bull markets, bear markets, recovery periods, and consolidation. Grayscale Research suggests that monitoring blockchain-based data indicators and market signals can help investors identify the current stage of the market cycle, optimizing risk management strategies.

Bitcoin’s price movements are not entirely random but exhibit statistical momentum characteristics—once a trend is formed (whether upward or downward), it often continues for some time. Over the long term, Bitcoin’s price fluctuates around a historical upward trendline, reflecting changes in market supply and demand as well as its gradual maturation as an asset class.

Drivers of the Current Bull Market

In 2023, the cryptocurrency market performed quite strongly, particularly Bitcoin’s price surging 44% in February, marking its largest monthly gain in the past three years. Analysts widely believe this bull market is just entering its active phase, driven by several key factors:

1. Expanded Market Access

With the launch of Bitcoin and Ethereum spot exchange-traded products (ETPs), more traditional investors can participate in the cryptocurrency market with lower entry barriers. This increased accessibility has significantly broadened the market’s funding sources and enhanced the acceptance of mainstream assets like Bitcoin and Ethereum.

2. Improved Regulatory Environment

The newly elected members of the U.S. Congress may bring clearer regulatory frameworks for the cryptocurrency market. Transparent and standardized regulations not only boost investor confidence but also attract more institutional investors, further driving market growth.

3. Supportive Macroeconomic Factors

As the global economy gradually recovers, the attractiveness of cryptocurrencies as alternative investment tools has increased. Against a backdrop of rising inflation and a weakening dollar, assets like Bitcoin are viewed as a hedge against traditional asset volatility.

Historical Cycle Analysis: What Lies Ahead?

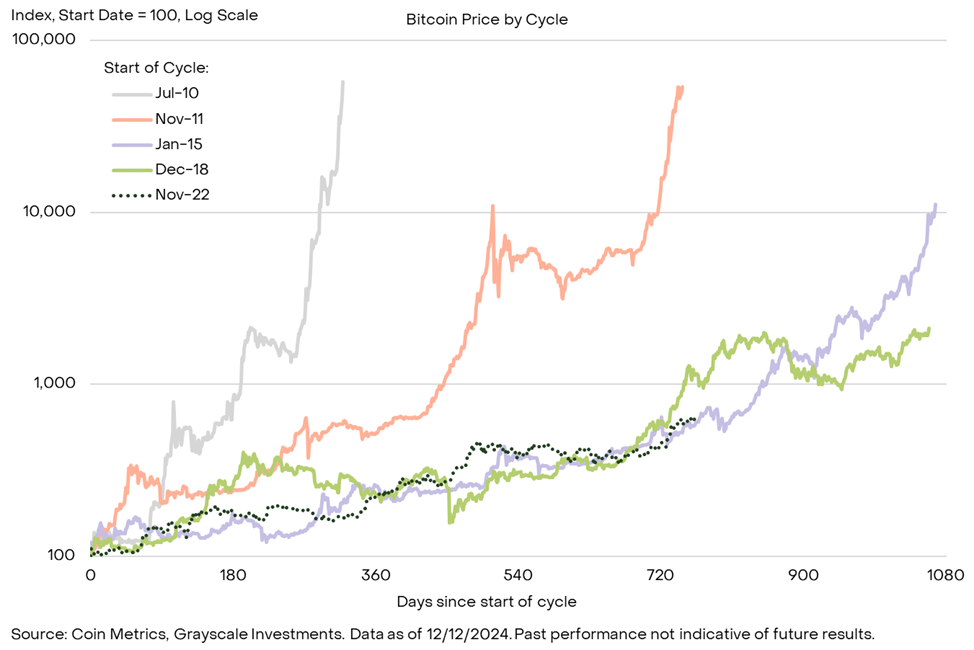

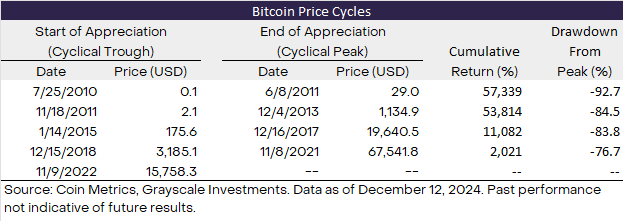

According to Grayscale Research, Bitcoin’s historical cycles typically consist of two phases: rapid price increases followed by price retracements. Early cycles had shorter durations and higher growth rates—e.g., the first cycle lasted less than a year with gains exceeding 500%, while the second cycle lasted about two years with similar gains. More recently, cycles have lasted longer, with more moderate gains. For instance, the 2015 to 2017 cycle saw a price increase of about 100x, while the 2018 to 2021 cycle increased by approximately 20x.

The current cycle began in November 2022 when Bitcoin’s price reached a low point of around $16,000. Since then, prices have gradually risen, though not with the same dramatic gains seen in earlier cycles, indicating a strong upward trend.

Chart analysis shows that Bitcoin’s price movements in this cycle resemble those of the previous two market cycles. Based on historical patterns, this cycle may have at least another year of upward momentum, with further price gains likely.

Analysis of Core On-Chain Metrics

Grayscale Research emphasizes that, aside from price data, on-chain metrics are essential tools for assessing market cycles. Here are some commonly used on-chain indicators:

1. MVRV Ratio

The MVRV ratio compares market capitalization to realized value (the total value of recent on-chain transactions) and is used to measure market valuation levels. Historically, the MVRV ratio typically reaches over 4 at price peaks. Currently, the ratio stands at 2.6, suggesting the market remains in a mid-cycle phase.

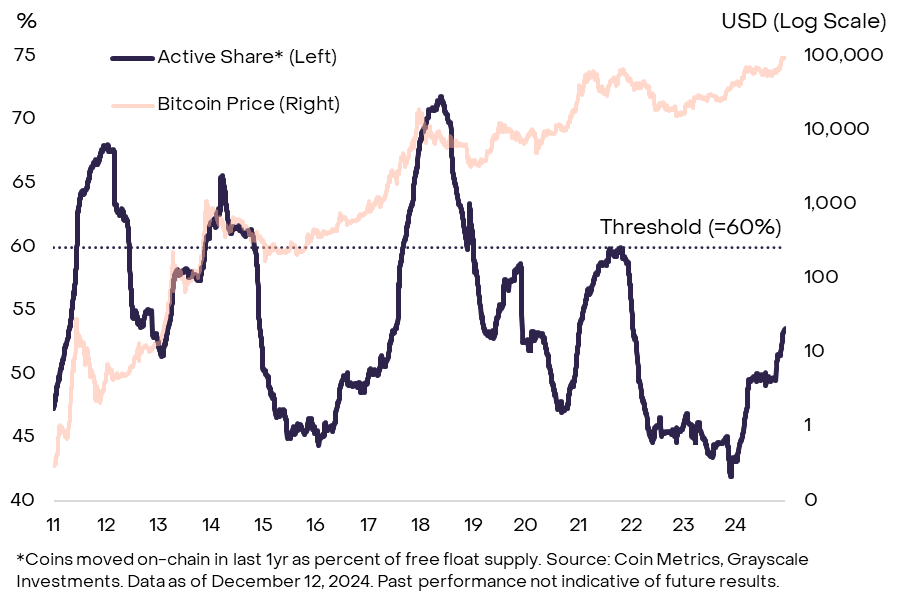

2. HODL Waves Indicator

This indicator measures the proportion of Bitcoin that hasn’t moved in the past year compared to the total circulating supply. During bull markets, new capital inflows often lead long-term holders to reduce their holdings, boosting market activity. Historically, this ratio typically reaches over 60% at bull market peaks, whereas it currently stands at 54%, suggesting there may still be upward potential.

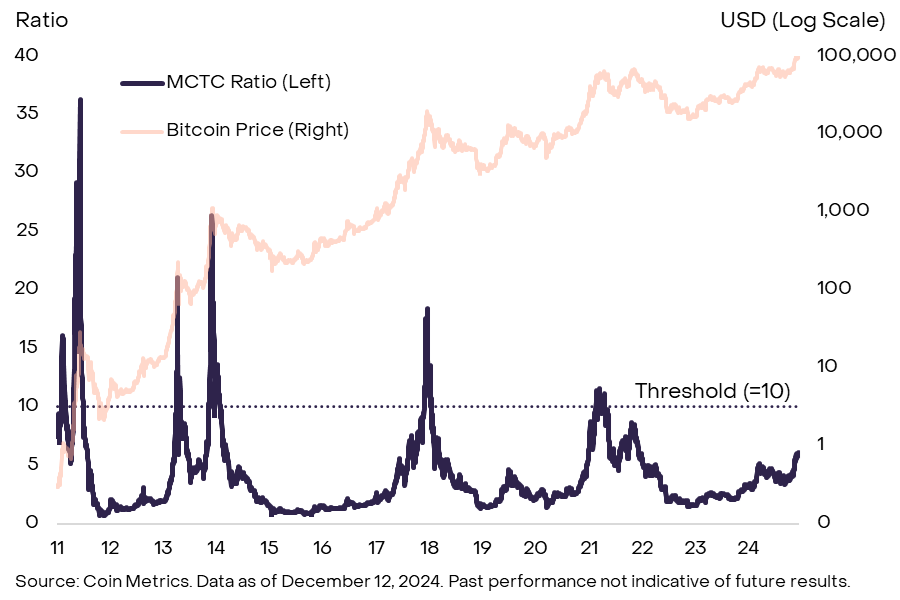

3. Miner Behavior Metrics

The miner’s holding value (MC) to cumulative earnings (TC) ratio is another key metric. Historically, when this ratio reaches 10, market prices tend to approach peaks. The current ratio stands at 6, further supporting that the current bull market remains in its mid-cycle phase.

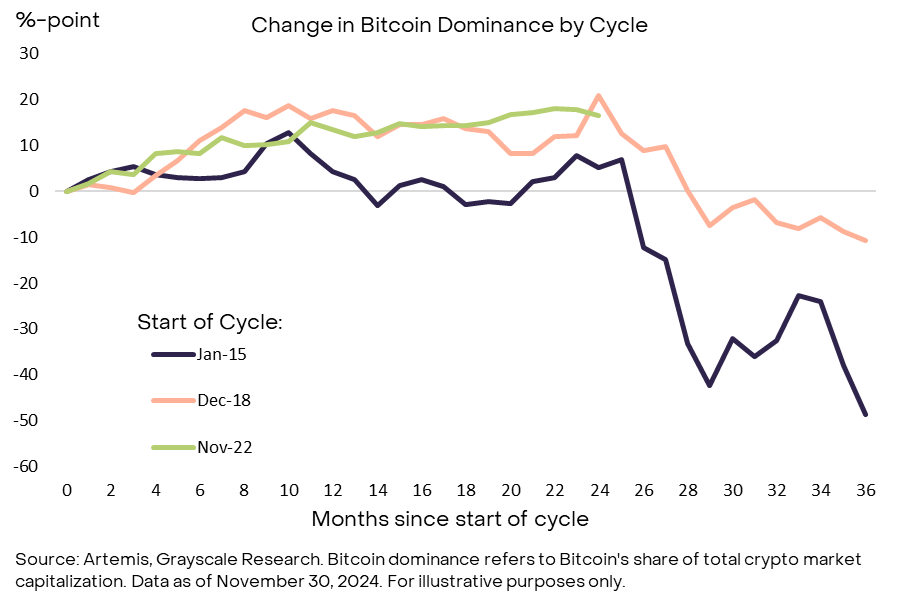

Performance of Other Cryptocurrency Assets

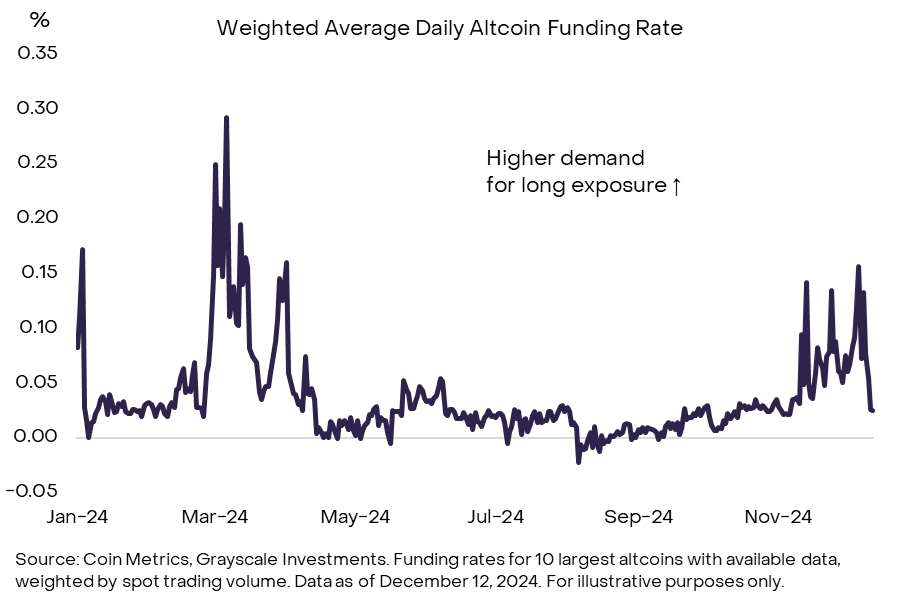

Although Bitcoin remains the dominant asset in the market, its market share tends to peak in the early years of a bull market. Other cryptocurrencies, such as Ethereum and major altcoins, also warrant attention. Metrics like funding rates and open interest (OI) reflect market sentiment and capital flows.

Currently, perpetual contract funding rates for altcoins are positive, indicating strong demand, but they haven’t reached excessive speculative levels. Open interest is nearing historical highs, suggesting increased speculation, which could pose risks of market corrections.

The Role of the U.S. Market

The U.S. market plays a critical role in this current bull cycle. On one hand, the approval of Bitcoin and Ethereum spot ETPs provides new investment tools for traditional investors. On the other hand, improvements in the regulatory environment are gradually shaping a more favorable landscape for cryptocurrencies to integrate into global capital markets.

As Bitcoin continues to be regarded as a digital commodity, its price may increasingly correlate with fundamental factors and trend-based fluctuations. For investors, analyzing on-chain data and market indicators remains essential in formulating risk management strategies.

Key Terms: Bitcoin cycles, cryptocurrency bull markets, on-chain indicators, Grayscale Research, miner behavior