The truth behind the Ethereum bull market: The rise of blue-chip assets or a precursor to a bubble

summary:

The truth behind the Ethereum bull market: The rise of blue-chip assets or a precursor to...

summary:

The truth behind the Ethereum bull market: The rise of blue-chip assets or a precursor to... The truth behind the Ethereum bull market: The rise of blue-chip assets or a precursor to a bubble bursting?

Ethereum in a Bull Market: An Undervalued Blue Chip or a Slipping Giant?

In the recent bull market, Ethereum (ETH), as the "king of public blockchains" in the blockchain space, has garnered significant attention. However, compared to the strong growth seen by other emerging blockchains, Ethereum’s performance appears somewhat lackluster. Since the end of 2023, while Ethereum has seen a price surge, its on-chain activity and user growth have shown signs of stagnation.

1. Lackluster Price Performance

From October 2023 to December 2024, Ethereum's price experienced a maximum increase of around 170%, hovering around the $4,000 mark without breaking key psychological thresholds. In contrast, Bitcoin (BTC) saw a price increase exceeding 300%, and Solana (SOL) surged by 1,300%. This performance raises questions: is Ethereum still the leading blue-chip blockchain it once was?

While Ethereum continues to dominate in the smart contract platform space, investor sentiment appears increasingly skeptical regarding its future prospects.

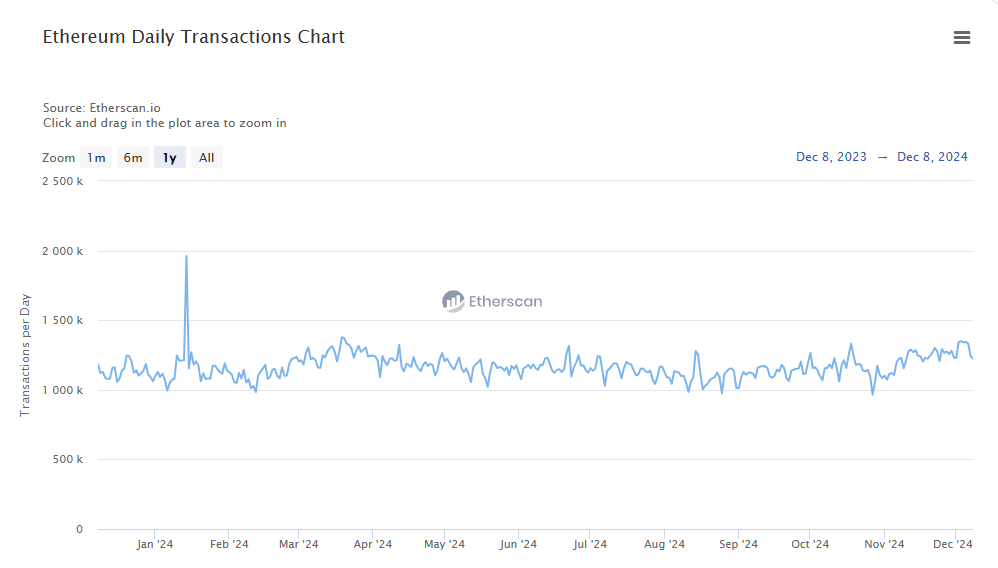

2. On-Chain Activity Stagnation

On-chain data clearly illustrates Ethereum’s activity has stagnated over the past year. On December 8, 2023, Ethereum’s daily transaction volume on the mainnet was 1.18 million, rising only to 1.22 million on December 8, 2024 – effectively unchanged. A brief spike in January 2024 saw a peak of 1.96 million, but otherwise, transaction volumes have remained in the 100,000 to 130,000 range.

Gas fees also highlight another key issue. From late 2023 to early 2024, gas fees hovered above 40 Gwei. However, with the rise of new blockchains like Solana, gas fees have dropped significantly, falling to as low as 0.3 Gwei from July to September 2024. This indicates reduced on-chain activity and user demand, as the high fees that once led to congestion have largely disappeared.

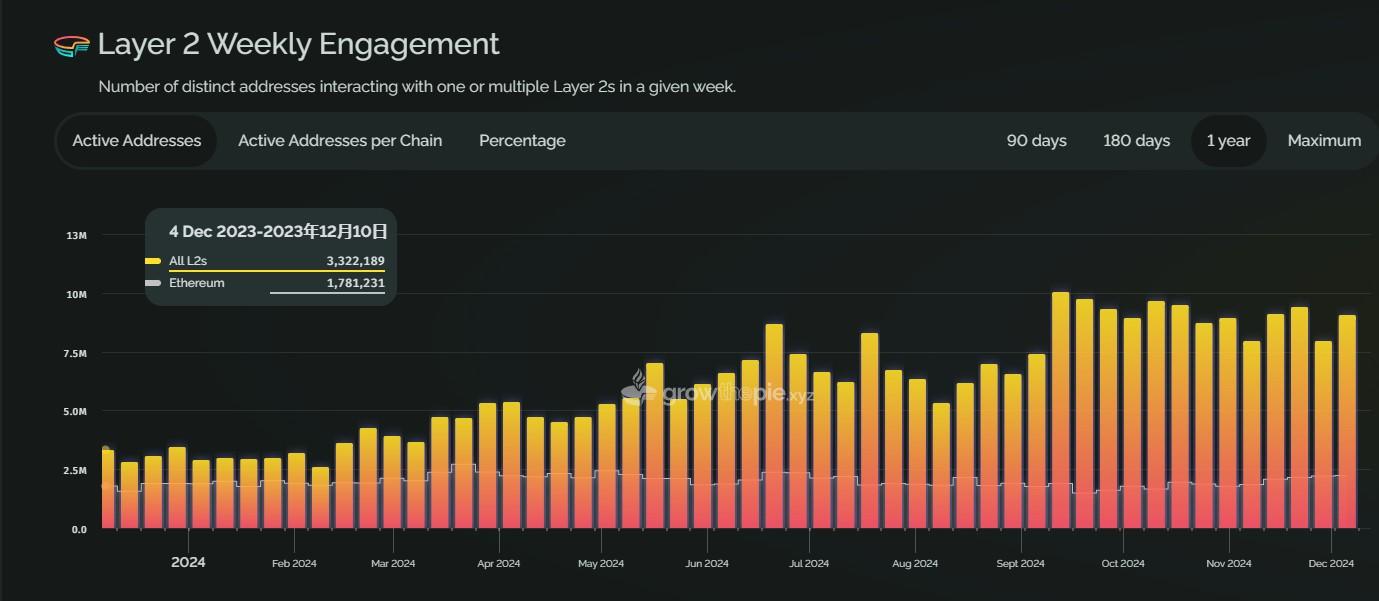

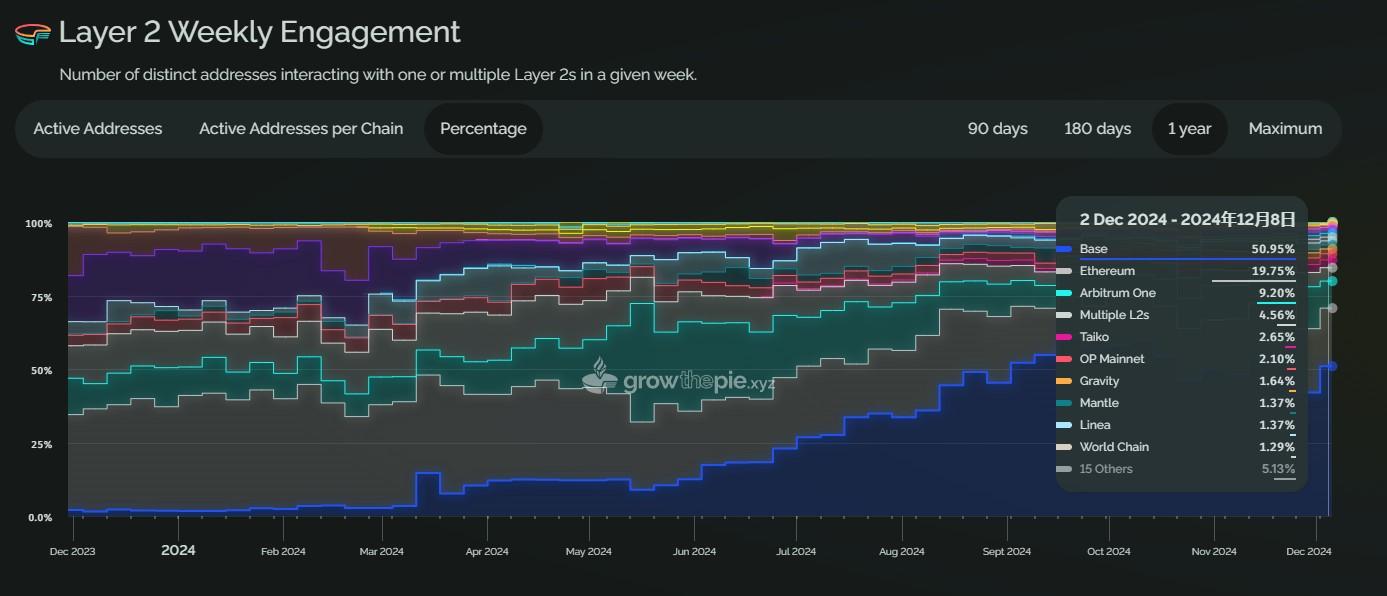

3. User Exodus and the Rise of Layer 2

With the growing adoption of Layer 2 solutions (like Arbitrum and Optimism), a significant portion of users and transactions have migrated from Ethereum’s mainnet to Layer 2 networks. By the end of 2024, Ethereum’s share of active addresses on Layer 2 had dropped to 24%, compared to 50% at the end of 2023. Meanwhile, Layer 2 networks are experiencing increasing activity.

The distribution of on-chain activity has also shifted. In December 2023, Ethereum accounted for 32.48% of blockchain activity, but by December 2024, this had fallen to 19%, while Base chain now holds 50% and Arbitrum ranks third at 9.2%.

4. Large Capital Flowing to Mainnet, Retail Users Fleeing

Despite a decline in active users, Ethereum maintains a strong position in large capital and the decentralized finance (DeFi) sector. The total value locked (TVL) on Ethereum’s mainnet remains dominant. In December 2023, Ethereum’s TVL was $288 billion, growing to $775 billion by December 2024 – an increase of 2.69 times, far surpassing ETH’s price gains.

In contrast, Layer 2 TVL is growing rapidly but still pales in comparison. For example, Arbitrum and Base rank second and third in stablecoin TVL, but both trail Ethereum’s 91% dominance. This suggests that large capital prefers Ethereum’s mainnet for asset security rather than seeking lower-cost transaction efficiency.

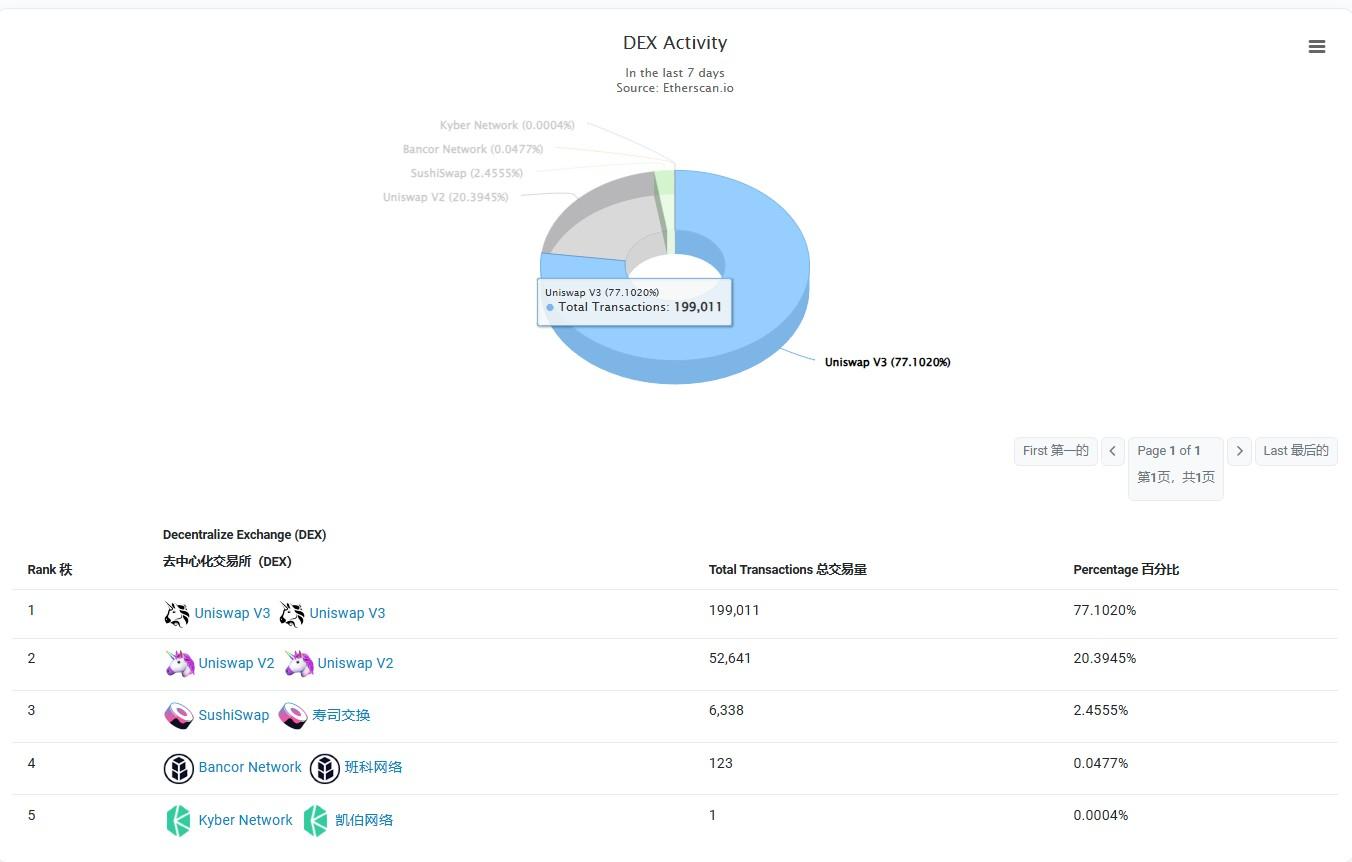

5. Potential Threat from Uniswap

Uniswap, a major DeFi application within Ethereum’s ecosystem, dominates over 97% of the DEX trading volume on the mainnet. It has burned over 6,372 ETH in the past 30 days alone. However, Uniswap plans to launch its own chain (Unichain), posing a potential threat to Ethereum’s mainnet.

According to Forbes, if Uniswap migrates to its own chain, Ethereum validators could lose between $400 million and $500 million annually. This could undermine Ethereum’s narrative of a deflationary currency. Uniswap’s general router consumes 14.5% of Ethereum’s gas fees, burning ETH worth $16 billion.

6. Shifting Role of Ethereum

From the data above, it’s clear that Ethereum’s mainnet is shifting from a preferred platform for small investors and high-frequency traders to a repository of high-value, secure assets. Although lower gas fees have eased transaction costs, Ethereum still struggles to compete with Layer 2 solutions and other blockchains in terms of speed and cost.

Ethereum’s mainnet still holds significant "value," with average TVL per active user at $178,700 – much higher than Base and Solana, at $3,315 and $1,972, respectively. This suggests that Ethereum remains the preferred choice for institutions and large capital, though its dominance in retail use cases is diminishing.

Tags: Ethereum, Layer 2, DeFi, Bull Market, Uniswap