An in-depth reveal of the inside story of Movement airdrop: 98.5% of the addresses earned over 100 M

summary:

An in-depth reveal of the inside story of Movement airdrop: 98.5% of the addresses earned...

summary:

An in-depth reveal of the inside story of Movement airdrop: 98.5% of the addresses earned... An in-depth reveal of the inside story of Movement airdrop: 98.5% of the addresses earned over 100 MOVEs, and a single whale collected 490,000 MOVEs

In-Depth Analysis of Movement Airdrop: 98.5% of Addresses Earn Over 100 MOVE, Single Whale Collects 490,000 MOVE Tokens

On December 9th, Movement Layer1 launched its airdrop, leading major cryptocurrency exchanges to list MOVE tokens.

On December 9th, the modular blockchain project Movement announced the airdrop of its native MOVE token, with leading cryptocurrency exchanges like Binance, OKX, Upbit, and Coinbase quickly listing the MOVE token. Movement became one of the rare “full listing” projects this year. This news quickly ignited excitement in the crypto community, with numerous users sharing their airdrop earnings on social media. While some users earned tens of thousands of MOVE tokens, others missed the opportunity due to complex processes or high fees.

Airdrop Data Reveals Distribution Patterns

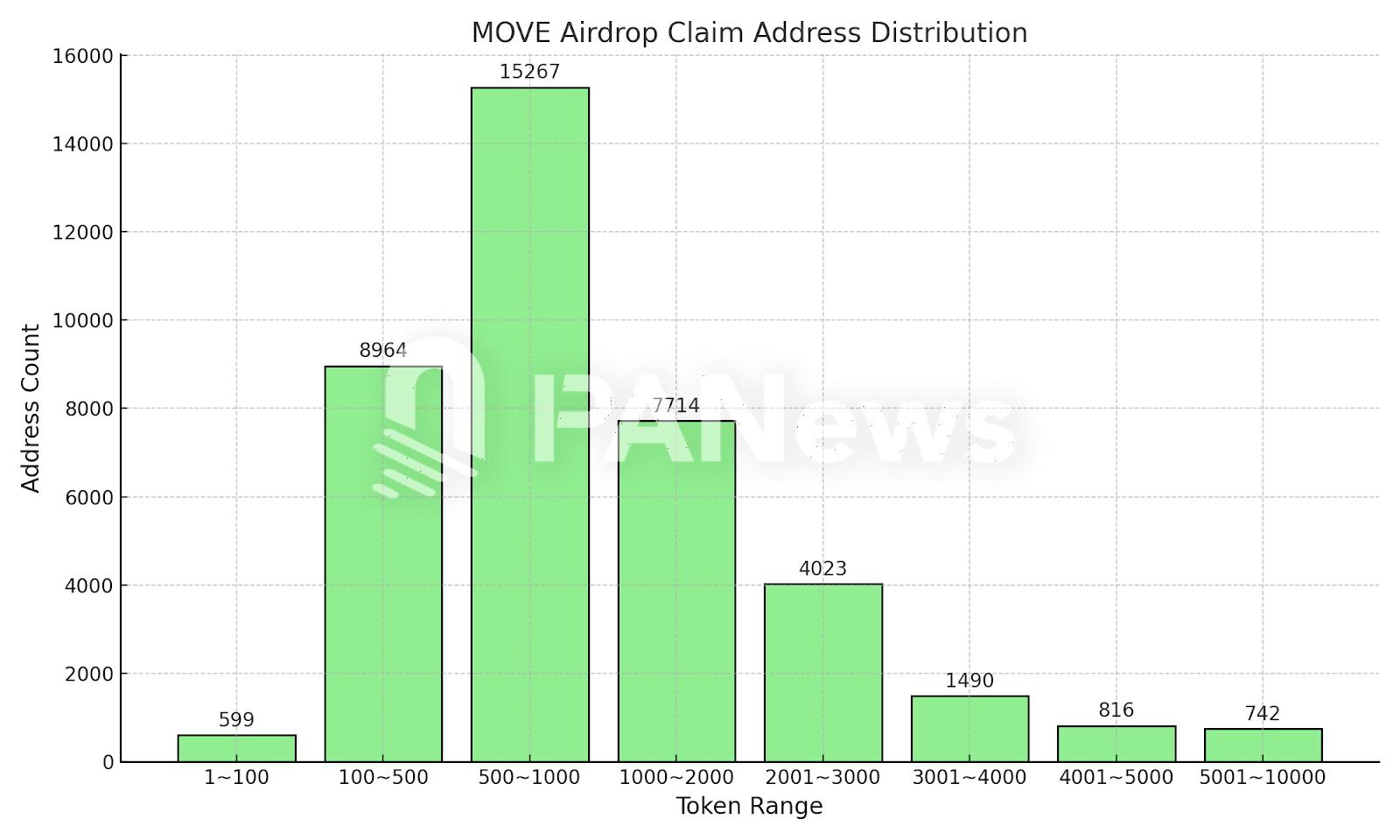

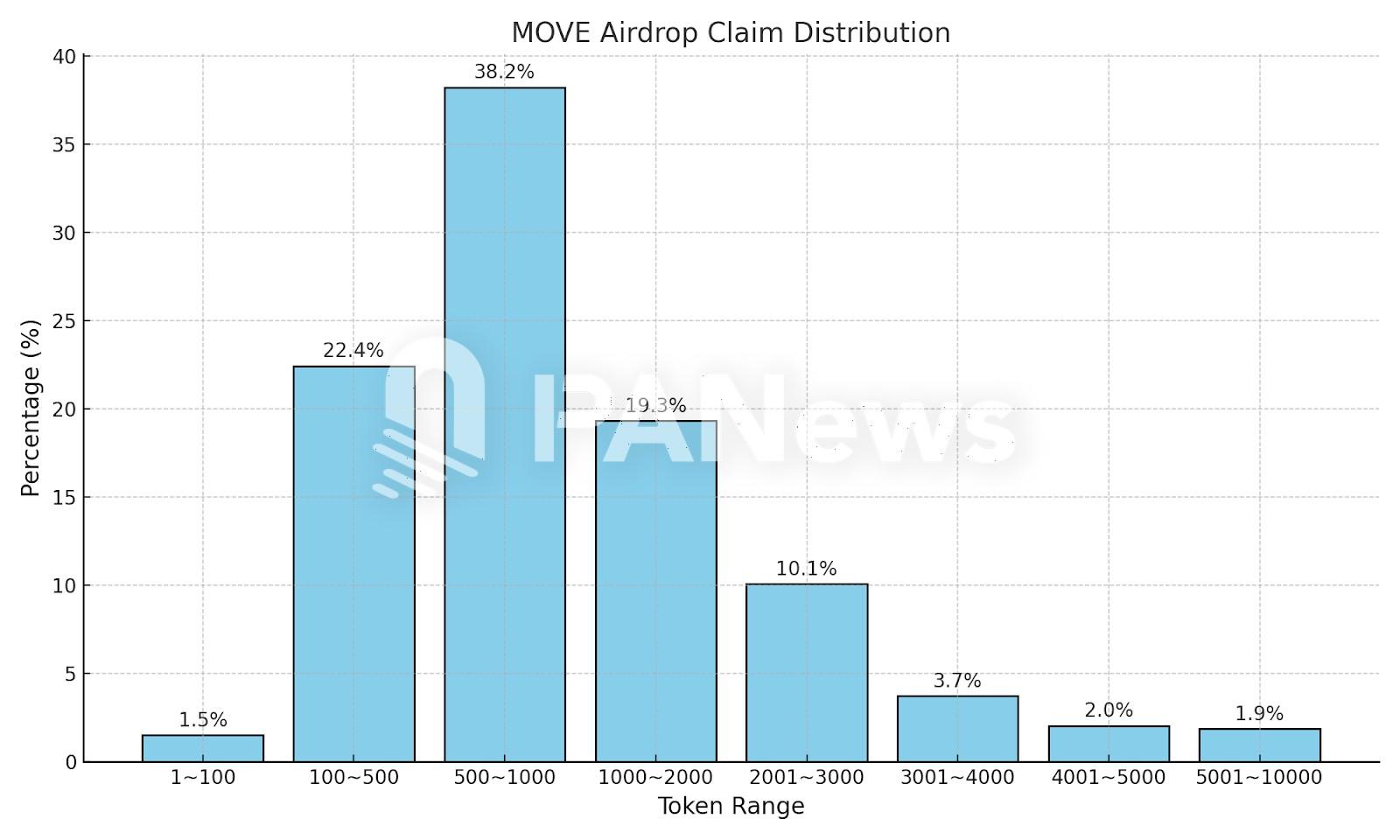

As of December 10th, on-chain data shows approximately 39,900 MOVE airdrop claim transactions were completed. Analyzing these claims, the distribution of airdropped tokens was as follows:

Addresses receiving over 10,000 tokens totaled 429;

Addresses receiving over 100,000 tokens amounted to 6;

Addresses claiming between 500-1,000 tokens represented 38.24%, the largest group;

Addresses claiming 100-500 tokens accounted for 22.45%;

Addresses claiming between 1,000-2,000 tokens represented 19.32%.

In total, 80% of addresses received between 100-2,000 tokens, while only 1.5% of addresses received fewer than 100 tokens. This indicates that Movement’s airdrop strategy was relatively user-friendly, with 98.5% of users accumulating token values exceeding $100. However, some addresses that didn’t claim due to high fees may choose to claim once the mainnet launches.

Whales Profited Significantly, Single Address Earning Up to $50,000

While Movement emphasized a "fair distribution" approach, some whales reaped substantial profits. For example, the address 0x8f2e314a0081bdcdf304c0e1fdbd8e28ff7a82e4 acquired 148,000 MOVE tokens through 35 sub-addresses, reaching a peak value of $215,000, with an average earning of 4,253 tokens per address. The largest single address, 0x49130A1938b6498B3D7Cf6B856Afd91e75D8f087, claimed 493,333 MOVE tokens, valued at approximately $50,000. This address has since moved some tokens to Binance.

Compared to other projects, this top-tier address earned more than StarkNet (worth $360,000) and Jupiter (worth $130,000), but less than HYPE’s $9.56 million. Notably, only 1.14% of addresses received more than 10,000 tokens, indicating Movement’s preference for rewarding more users.

Airdrop Scale and Market Circulation Analysis

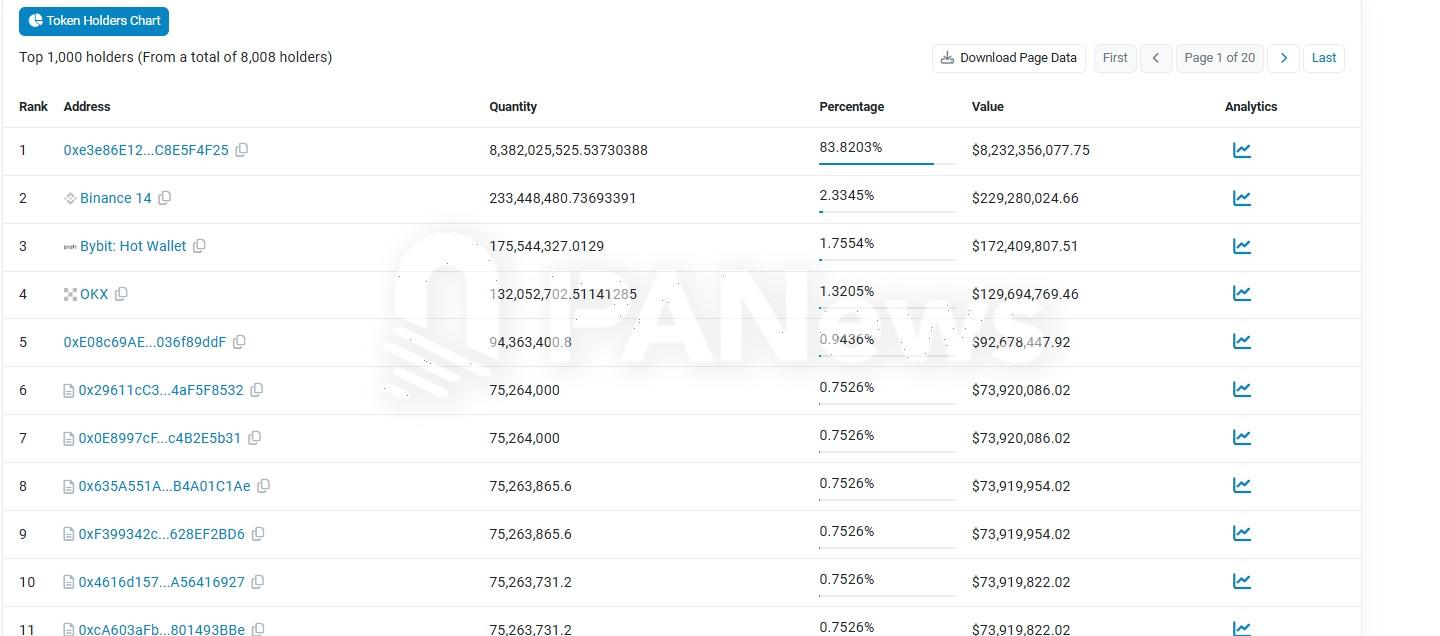

The total airdrop allocation amounted to $1.45 billion, surpassing HYPE’s $620 million. Official data indicates that approximately 420 million MOVE tokens have been claimed, leaving 580 million yet to be distributed. On-chain data shows that the largest official holder address still controls 83.8% of the total tokens, meaning the actual market circulation is only 16.2%, differing from the 22.5% mentioned in official announcements.

At the highest price of $1.45, MOVE’s circulating market cap reached $2.349 billion. This low circulation rate may negatively impact secondary market liquidity and price performance.

Low On-Chain Liquidity and Significant Price Fluctuations

On December 9th, MOVE tokens were listed on multiple exchanges. However, due to severe on-chain liquidity constraints, there were significant price differences between centralized exchanges and decentralized exchanges. For example, MOVE prices on Uniswap peaked at $5.15, while Binance’s price was just $0.96, showing a 5.3x gap. These fluctuations offered opportunities for arbitrage. As of December 10th, Uniswap’s liquidity pools held less than $20,000, in stark contrast to MOVE’s market cap of $2 billion.

South Korea’s market stood out prominently. Coinone opened first, pushing MOVE prices to around $700, prompting Upbit and Bithumb to delay their listings. Korean markets maintained higher MOVE prices until December 10th, when fluctuations began to stabilize.

Trends in Altcoin Seasons and Airdrop Frenzy

As the crypto market enters an “altcoin season,” many projects have chosen this time to conduct token airdrops. Movement is one such example. The limited number of participants in MOVE’s airdrop may have enabled it to achieve a higher level of "low-tier" airdrop distribution. However, investors should remain cautious of the changes in actual circulation and Movement’s progress with its mainnet development.

Tags: Airdrop, Cryptocurrency, MOVE Token, On-Chain Data, Market Circulation