The Federal Reserve cut interest rates by 1 basis point! The expectation of interest rate cuts next

summary:

The Federal Reserve cut interest rates by 1 basis point! The expectation of interest rate...

summary:

The Federal Reserve cut interest rates by 1 basis point! The expectation of interest rate... The Federal Reserve cut interest rates by 1 basis point! The expectation of interest rate cuts next year has been significantly reduced to only 2 basis points, and the global market has adjusted back

The Federal Reserve's Recent Rate Cut and Its Implications

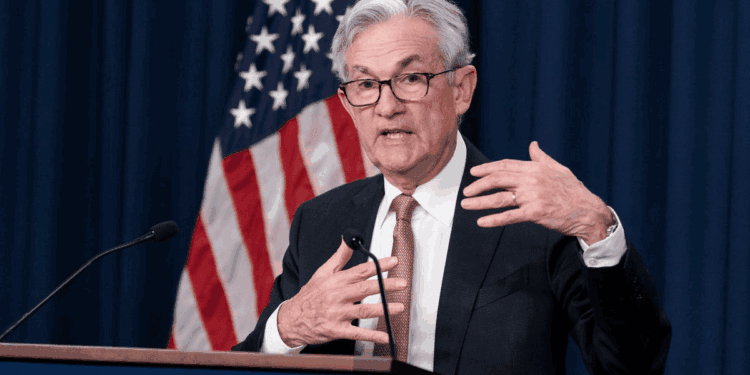

The Federal Reserve (Fed) announced today that it is lowering the benchmark interest rate by 0.25 percentage points to a range of 4.25%-4.5%. This marks the third consecutive rate cut in 2024. Although inflation in the U.S. has not fully subsided, with the annual growth rate remaining at 2.7%, the Fed is striving to balance its dual mandate of "price stability" and "maximum employment." Fed Chair Jerome Powell stated in a press conference that while there is no immediate urgency to implement further rate cuts, future policy decisions will depend on continued improvements in inflation data. Powell also emphasized that the likelihood of a rate hike in 2025 is very low.

Background and Motivation for the Fed's Policy Adjustment

The Fed's decision to lower interest rates comes amid an increasingly complex global economic environment. Since 2023, economic growth in major global economies has slowed significantly. While the U.S. economy has shown resilience under tight monetary policy, inflation has steadily declined from its peak in 2022, nearing the Fed’s long-term target of 2%.

The Fed's policy statement included a focus on the "pace" and "timing" of adjustments, hinting at a more cautious approach to rate cuts. Powell noted that while the U.S. economy remains robust, with GDP growth projected at 2.1% for 2024, inflation remains a significant challenge. Core Personal Consumption Expenditures (PCE) inflation is expected to decrease to 2.5% by 2025.

Dot Plot Reveals Future Policy Directions

The Fed's dot plot indicates a significant shift in the outlook for future rate cuts. Predictions for 2025 have been reduced from four rate cuts in September to just two, each likely by 0.25 percentage points. This adjustment reflects a more cautious stance on monetary policy and underscores the Fed’s focus on observing inflation trends and economic conditions.

Markets reacted swiftly to adjustments in the dot plot, with risk assets facing selling pressure. For instance, Bitcoin’s price fell by 5% after the announcement, while other cryptocurrencies saw declines of 5%-10%. Investors appear to be repositioning in response to the global economic outlook and monetary policy trends, redirecting funds toward safe-haven assets.

The Long-Term Battle Between Inflation and Monetary Policy

The Fed’s monetary policy primarily revolves around adjustments to the benchmark interest rate, aiming to influence borrowing costs and consumer demand to control inflation. However, current inflation drivers are complex, including global supply chain disruptions, energy price volatility, and persistent labor market tightness—challenges not easily addressed by monetary policy alone.

Core PCE inflation, a metric that excludes volatile items like food and energy, remains a key focus for the Fed. Recent data suggests core PCE inflation will decline to 2.5% by 2025. While slightly above the Fed’s target, this indicates a gradual easing of inflationary pressures.

Additionally, the state of the labor market directly impacts inflation. With the unemployment rate expected to stabilize at 4.2%, wage growth’s contribution to inflationary pressures may diminish, though the risk of a secondary inflation surge remains.

Broad Market Impacts of the Rate Cut

The rate cut has had widespread effects on markets. U.S. Treasury yields have rebounded, reflecting concerns about future economic growth. Stock markets have reacted negatively to policy uncertainty, with tech stocks and high-risk assets experiencing heightened volatility.

The cryptocurrency market has been particularly impacted. Despite typically being seen as a hedge in a low-interest-rate environment, Bitcoin’s price decline following the Fed’s announcement suggests growing investor concerns about the overall economic outlook.

In the foreign exchange market, the U.S. dollar index has weakened as expectations for reduced interest rate advantages erode. Conversely, the euro and yen have strengthened against the dollar, influencing trade, capital flows, and international markets.

The Fed’s Role in the Global Economic Landscape

As one of the world’s most influential central banks, the Fed’s policies extend beyond the U.S., shaping the global economic landscape. This rate cut may prompt other countries to reassess their monetary policies, particularly export-dependent emerging markets facing inflationary pressures.

For instance, the European Central Bank and the Bank of Japan may consider delaying further tightening or accelerating rate cuts to stabilize exchange rates and stimulate growth. Meanwhile, the International Monetary Fund (IMF) may adjust global economic growth forecasts to account for heightened monetary policy uncertainties.

Advice for Individual Investors

For individual investors, a rate-cutting environment often leads to lower borrowing costs, reducing expenses for mortgages, car loans, and other financing, thereby boosting household spending power. However, lower interest rates may also reduce returns on fixed-income products such as savings accounts and certificates of deposit. Investors should consider diversifying their portfolios with assets like stocks, bonds, and gold.

The market volatility associated with rate cuts also highlights the risks of short-term speculation, particularly in sectors like cryptocurrencies and high-growth stocks. Investors should adopt a disciplined approach, avoiding impulsive trading decisions.

Keywords

Fed rate cut, inflation, core PCE index, cryptocurrency market, global economy