Bitcoin plummeted to $96,000! Is there any hope in the market outlook? Analysts interpret this

summary:

Bitcoin plummeted to $96,000! Is there any hope in the market outlook? Analysts interpret...

summary:

Bitcoin plummeted to $96,000! Is there any hope in the market outlook? Analysts interpret... Bitcoin plummeted to $96,000! Is there any hope in the market outlook? Analysts interpret this

After U.S. Federal Reserve (Fed) Chairman Jerome Powell signaled a hawkish stance and indicated that rate cuts next year would be more cautious, the cryptocurrency market continued its downward spiral today (20th), extending the panic from the previous day. Investor confidence has been severely shaken, leading to widespread declines among major cryptocurrencies.

Bitcoin failed to sustain the $100,000 threshold in the early hours of the day, quickly retreating to around $97,000. Although it briefly rebounded to $98,000, selling pressure proved overwhelming, causing it to drop below $96,000 at one point.

As of 10:30 a.m. Taipei time, Bitcoin was trading at $96,626, down 2.2% over the past 24 hours. Ethereum, meanwhile, fell 4.3%, dropping below the $3,500 mark.

According to data from CoinGlass, the cryptocurrency derivatives market saw approximately $1.2 billion in liquidations within 24 hours following the Fed’s latest rate decision, with over $1 billion of liquidations stemming from long positions. This suggests that the market’s prior bullish bets on price increases have been nearly wiped out.

Healthy Correction or Looming Storm?

Joel Kruger, Market Strategist at LMAX Group, stated that Bitcoin was already in an "overheated state" after surpassing $100,000, with correction pressure building for some time. The Fed’s hawkish stance acted as the "trigger," prompting the market to correct its previous excessive optimism.

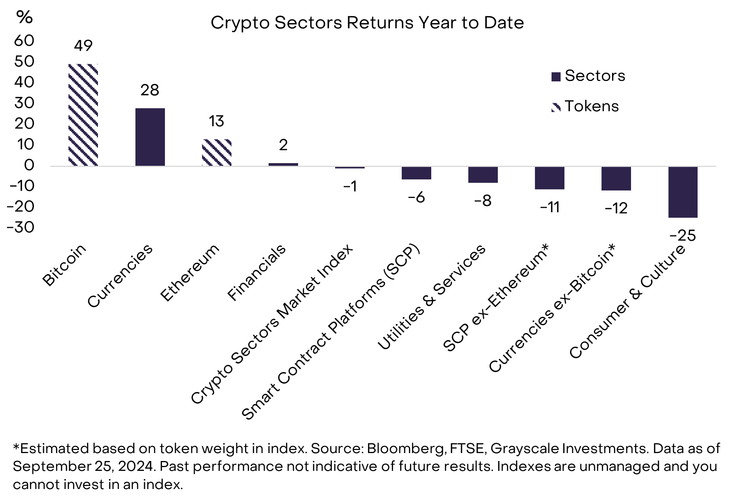

Azeem Khan, co-founder of Layer 2 network Morph, pointed out that while Bitcoin’s price has declined in the short term, this pullback could be viewed as healthy when considering its year-to-date gains.

He added that as the year-end approaches, some investors may sell off assets to manage their tax burdens. This behavior, historically not uncommon, could be one of the factors contributing to Bitcoin's recent downward pressure.

Does Bitcoin Have Room to Rebound?

Despite the current bearish sentiment, Paul Veradittakit, Managing Partner at Pantera Capital, remains optimistic about Bitcoin’s long-term fundamentals. Since the U.S. presidential election, Bitcoin has surged over 45%, largely benefiting from Donald Trump’s return to the White House and his commitment to pro-cryptocurrency policies. Trump has also advocated for the establishment of a "national Bitcoin reserve," which has injected strong confidence into the market.

However, investors should remain wary of the risks associated with excessive optimism. Zann Kwan, Chief Investment Officer at Revo Digital Family Office, warned that Bitcoin might drop to the $90,000 range in the short term. Nonetheless, she noted that such a dip could be temporary, and with flexible market adjustments, long-term upward momentum remains a possibility.